Question: Is there a personal finance tool that offers secure, cross-platform access to my financial data and provides bill notifications?

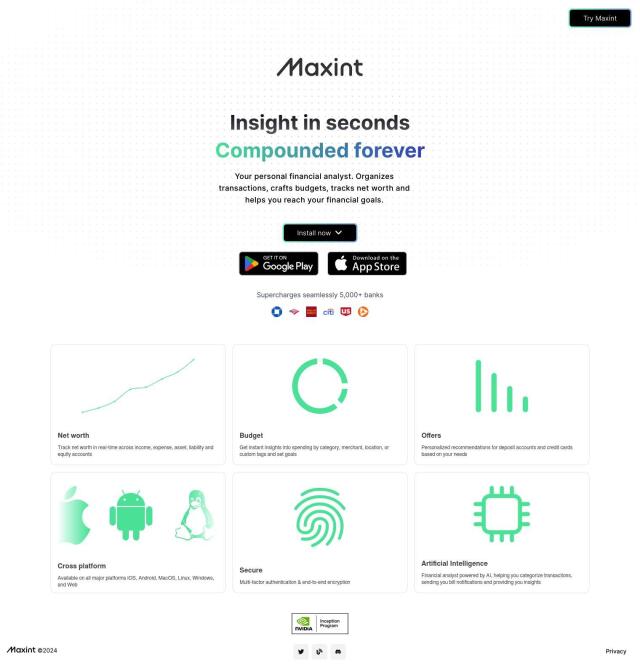

Maxint

If you're looking for a personal finance tool that offers secure, cross-platform access to your financial data and bill notifications, Maxint is a standout option. Maxint provides real-time visibility into multiple accounts, net worth tracking, and budgeting with immediate spending pattern analysis. It also offers personalized offers for financial products and sends bill due date notifications, making it a comprehensive solution for managing your finances securely across iOS, Android, MacOS, Linux, Windows, and Web platforms.

Kniru

Another excellent choice is Kniru, an AI-powered financial advisor platform that offers personalized insights and advice. It covers a range of financial planning topics, including investment advice, expense management, and retirement planning. Kniru also provides hyper-personalized notifications such as bill due date reminders and budget overages, helping you stay on top of your financial activity.

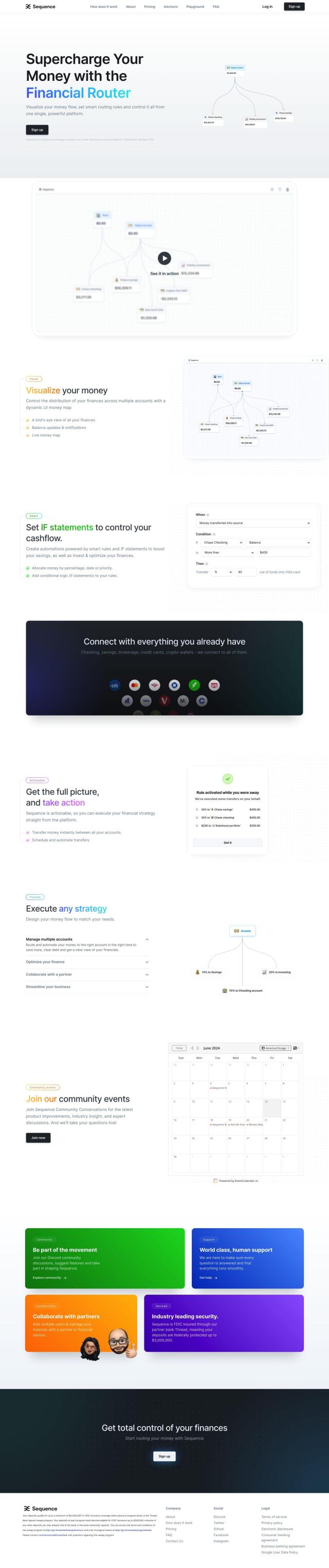

Sequence

For those who need more automated financial management, Sequence could be the right fit. This platform connects multiple financial accounts and offers a dynamic UI money map with live updates on your finances. Sequence also allows for custom automations using smart rules, which can optimize your savings, investments, and financial control, providing a robust solution for managing your financial flow.

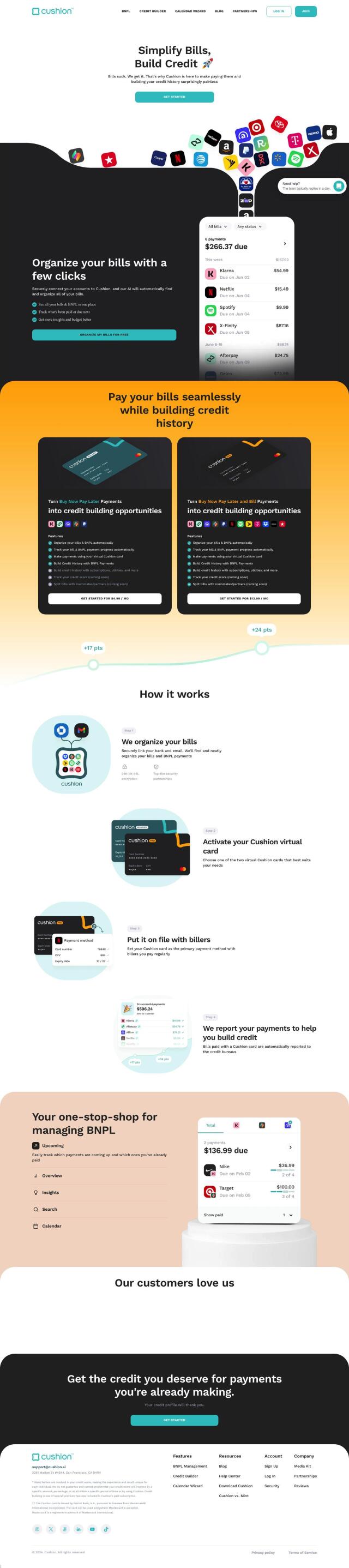

Cushion

Lastly, Cushion offers a unique feature set for bill and credit management. It securely links accounts to track and organize your bills, providing insights for better budgeting and payment management. Cushion also includes credit score tracking and BNPL management, making it a versatile tool for both financial organization and credit-building.