Question: Can you recommend a personal finance app that helps me track spending and create a budget?

Cleo

If you're looking for a personal finance app that helps you track spending and create a budget, Cleo could be a good option. The AI-powered assistant can link to your main bank accounts for a personalized budgeting, spending tracking and financial goal-setting service. It offers tools like daily spend limits, low balance warnings and bill payment. It also has "Roast" and "Hype" modes to give you a humorous or congratulatory assessment of your financial situation. Cleo promises security with 256-bit encryption and read-only access to your data, and it's available for iOS and Android.

Monarch

Another contender is Monarch, which offers a broader range of financial management tools. That includes AI-powered transaction rules for categorization, flexible budgeting, investment tracking and secure sharing with partners or financial advisors. Monarch protects your data with bank-level security and read-only access, and it's available on the web and mobile devices.

Fina

If you want something more flexible, check out Fina. The service accommodates unlimited custom categories, personal metrics tracking and flexible budgeting. It also has a scenario planning tool and deep financial connections to banks, loans and investments through Plaid. Fina uses AES-256 encryption and has an AI-powered question-answering service, and it's available in the US and Canada with a 7-day free trial.

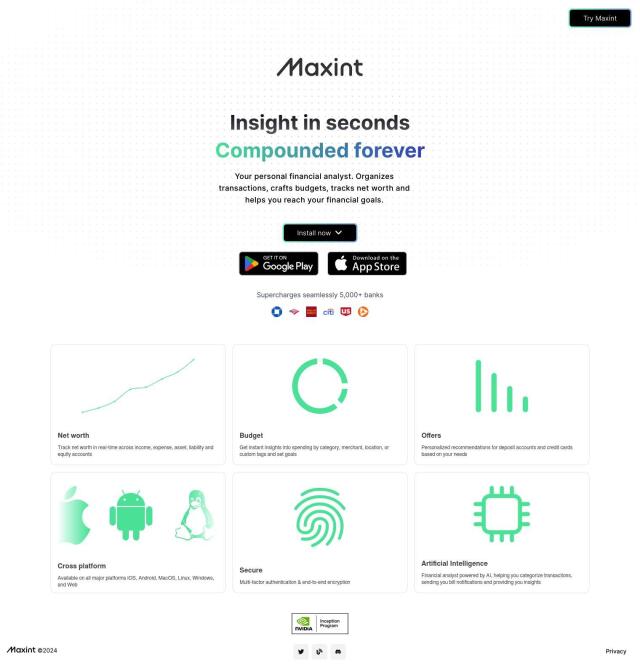

Maxint

Last, Maxint gives you real-time visibility into multiple accounts so you can monitor net worth, categorize transactions and set budgets. The service offers personalized recommendations and AI-powered financial insights, and it's available on iOS, Android and the web. Maxint protects your data with multi-factor authentication and end-to-end encryption, so your financial data is kept private.