Question: Is there a payment solution that can read credit cards in low-light or network-constrained environments?

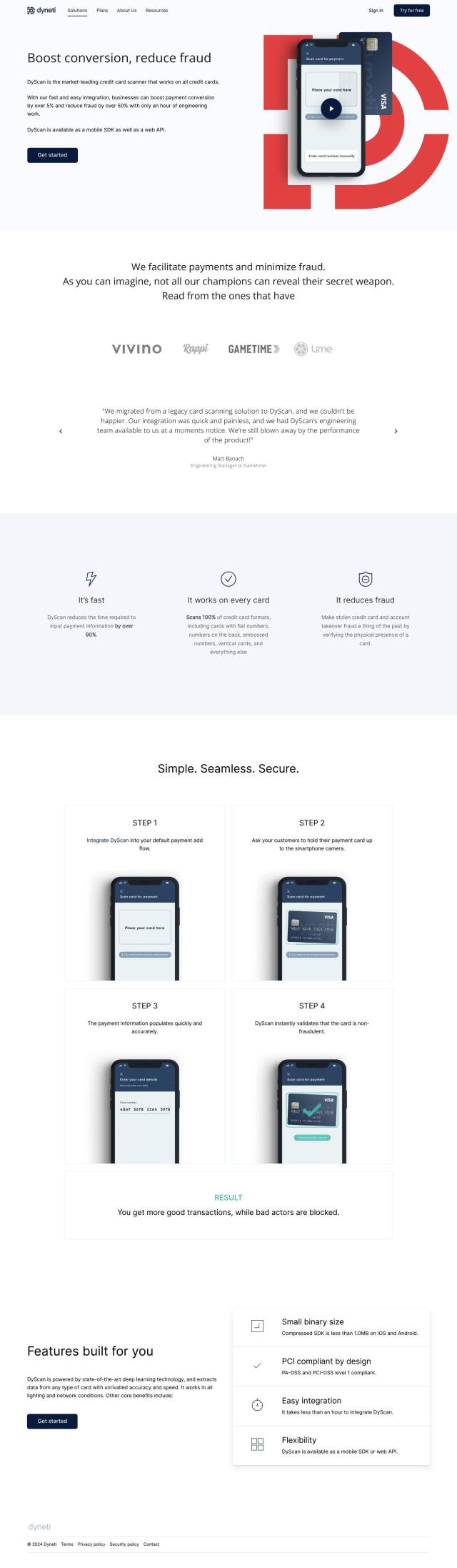

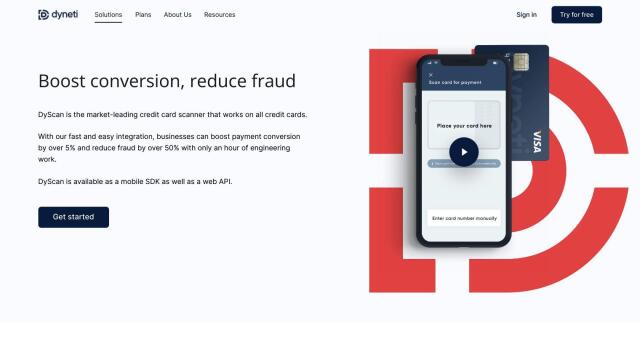

DyScan

If you're looking for a payment solution that can read credit cards even in dim or network-slow situations, DyScan is a great choice. It uses deep learning technology to capture card data accurately and quickly even in dim or network-slow situations. The SDK is compact (<1.0MB on iOS and Android), PCI compliant, and can be integrated in less than an hour. DyScan offers flexible pricing plans and is designed to speed up payments while cutting down on fraudulent transactions, so it's a good fit for businesses of all sizes.

Microblink

Another option is Microblink, which offers a range of AI-based products including BlinkCard for secure credit card scanning. Microblink has a strong reputation for industry-leading UX and supports more than 2,500 identity documents from 140+ countries. With features like 99.9% uptime and the ability to scan 95 documents per second, it's a good fit for industries like banking, finance and retail. Microblink also has ISO/IEC certifications for data security, so it's a good option for businesses.