Question: Can you recommend a platform that provides backtesting and visualization tools for options trading?

Option Alpha

If you're looking for a service that offers backtesting and visualization tools for options trading, Option Alpha is a good option. It offers more-advanced tools like the 0DTE Oracle for backtesting and finding 0DTE and next-day trades, and live interactive options payoff diagrams. The service also includes price range and earnings date visualizations, Earnings Edge for trading earnings reports, and automated position monitoring. It also offers a variety of subscription plans to suit different needs, including a 30-day free trial.

WealthCharts

Another option is WealthCharts, which marries AI technology with precise trading tools. It offers backtesting, strategy builder, options trading platform, and futures trading DOM. The service also comes with a library of 22 proprietary scanners and over 200 technical indicators, so it's good for traders of all skill levels. It supports multiple brokers and offers educational content like live streams and on-demand videos.

Tradytics

If you're looking for AI-powered tools, Tradytics could be a good fit. It offers premium options flow data, an AI-powered news feed, live options flow data, and advanced analytics tools. Tradytics is designed to help traders make better decisions by processing complex trading data and making it actionable. It offers a variety of pricing tiers, including a free basic access option, and offers educational resources to get started.

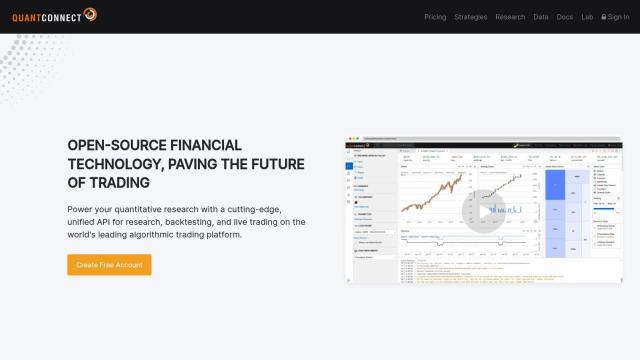

QuantConnect

Last, there's QuantConnect, an algorithmic trading platform geared for quants and engineers. It offers cloud-based tools for researching, backtesting, and live trading across multiple assets. With features like point-in-time backtesting, parameter optimization, and live trading with deployment to co-located servers, it's a good option for those who want to build and execute sophisticated trading strategies. The platform also can be customized with its open-source LEAN engine.