Question: I'm looking for a technology that can analyze market sentiment for stock and cryptocurrency investments.

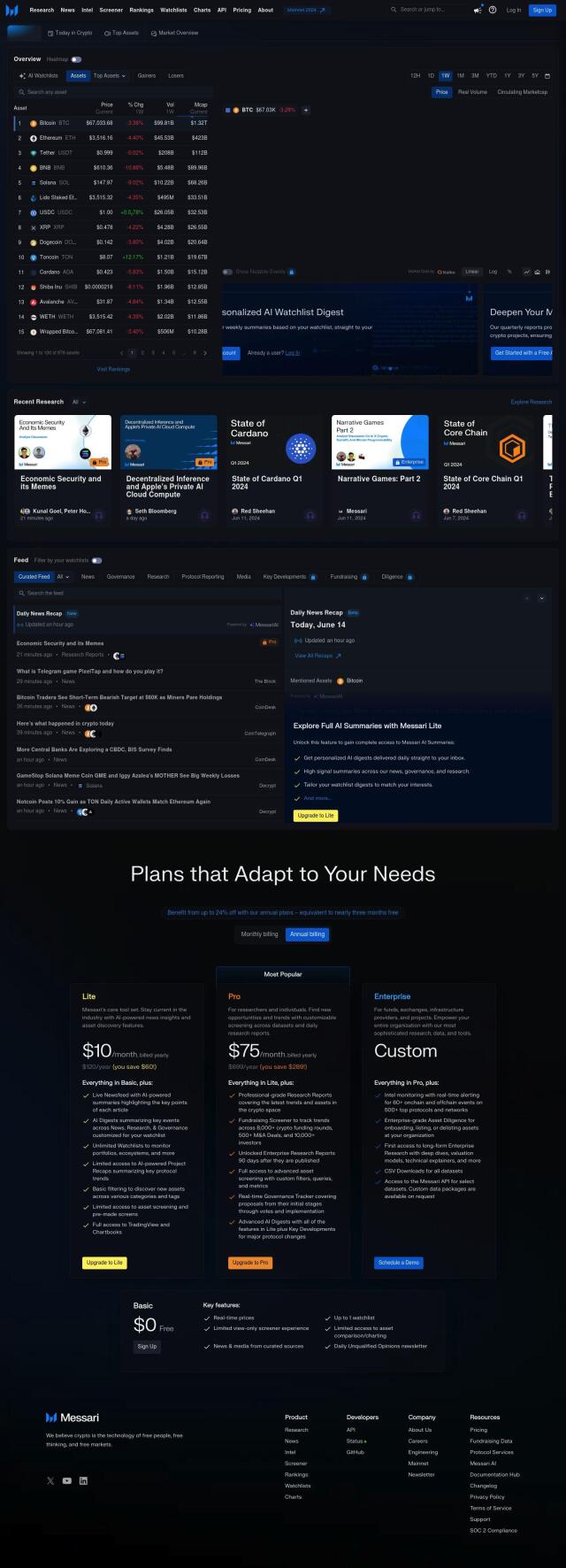

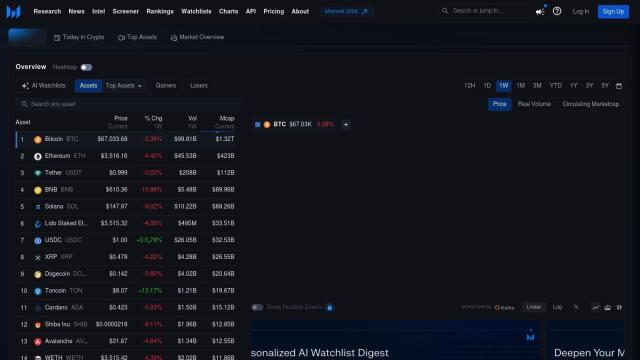

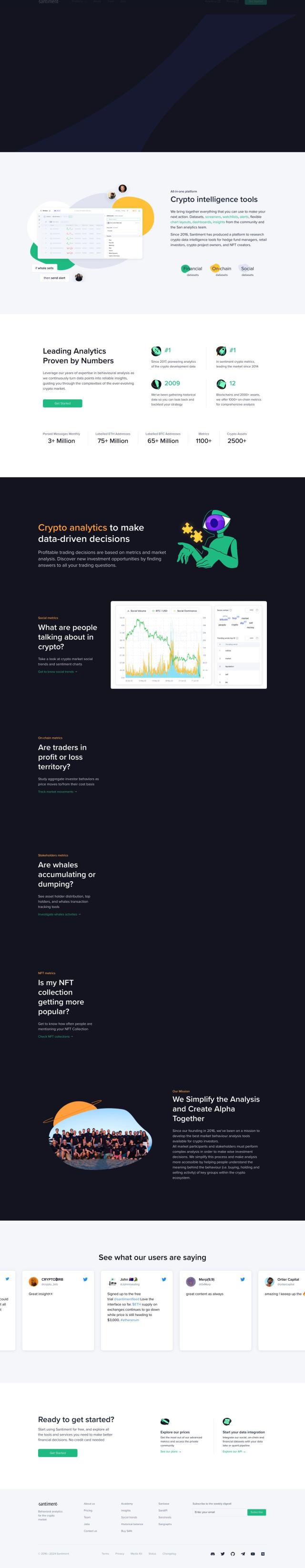

Santiment

Santiment is a crypto research platform with a lot of tools for analyzing markets and making trading decisions. It offers on-chain data, social data to gauge market sentiment, financial data for backtesting and stakeholders data to track whales. It's geared for hedge fund managers, retail investors and crypto project creators who want to cut through information asymmetry with data analysis.

Trading Central

Another serious contender is Trading Central, an analytics platform that combines AI analysis with the expertise of registered investment advisers for technical, fundamental, economic, sentiment and news analysis. The company's tools include Market Buzz, Fundamental Insight and Options Insight to help you find trading ideas and manage risk. It's got customizable integration and real-time data coverage, so it's good for online brokerages, marketing teams and individual investors.

CryptoQuant

For institutions and serious cryptocurrency investors, CryptoQuant offers an on-chain and market analytics service. It offers on-chain and off-chain data, proprietary metrics and customizable analytics tools. You can create your own metrics, build interactive dashboards and use community-created indicators. It's good for trading and risk management.

Alpha Vantage

Finally, Alpha Vantage is a financial market data API that offers real-time and historical data for stocks, options, forex, commodities and cryptocurrencies. It also offers AI-powered sentiment scores and more than 50 technical indicators. It's good for investors, researchers and developers.