Question: Is there a platform that can help me manage international money transfers with lower transaction costs and fast processing times?

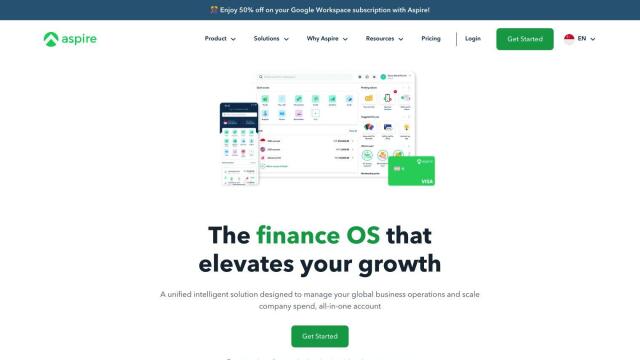

Aspire

If you need a platform to send money across borders with lower transaction costs and faster processing times, Aspire could be a good fit. Aspire is a multicurrency business account for startups and SMEs that includes multicurrency accounts, real-time visibility and fast, transparent FX payments. It's designed with security in mind and seeks to lower fees for international payments, making it a good choice for companies that are growing.

Inai

Another contender is Inai, a full-stack payment platform that automates payment operations for global businesses. It integrates with many payment service providers to accept payments, make payouts and optimize transactions. With tools like Optimize, Orchestrate, Reconcile and Alerts, Inai is designed to increase authorization rates, improve checkout experiences and lower transaction costs. It supports more than 50 payment vendors and 300 local payment methods in 180+ countries.

Fiskl

For smaller businesses, Fiskl offers an AI-powered multicurrency accounting platform that supports more than 170 currencies. It includes invoicing, payment tracking, automated bank sync and global invoicing. Fiskl also integrates with several financial institutions and Stripe for multicurrency bulk payouts, making it a good option for handling international transactions without a lot of hassle.

Zamp

And Zamp offers a cash management system for global businesses. It offers real-time visibility, automated cash forecasting and smart reconciliation. Zamp's Payments Command Centre and Unified Payments API automate global payments, letting businesses lower risk and optimize cash management with sophisticated security.