Question: Can you recommend a fraud prevention service that offers virtual credit cards and masked email addresses for online transactions?

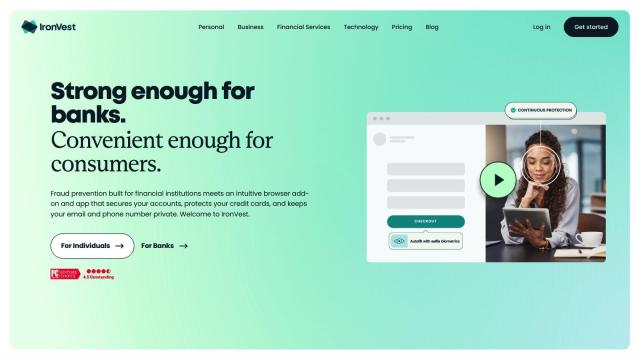

IronVest

If you want a more comprehensive fraud prevention service with virtual credit cards and masked email addresses, IronVest is a top contender. It offers strong protections like biometric authentication, virtual credit cards, masked email addresses and a host of other online protection features. It's designed to work directly in your online life through browser extensions and mobile apps, so it's easy to use and works on whatever device you have.

IPQS

Another strong contender is IPQS, an artificial intelligence-based fraud detection system that offers real-time insights through sophisticated algorithms that scrutinize more than 300 data points. It comes with features like proxy and VPN detection, email verification, phone validation and fraud scoring. IPQS also can be integrated with services like Hubspot and Salesforce, so it's a good option for businesses that want to improve fraud prevention and cybersecurity.

IBM Security Trusteer

If you want a cloud-based service, IBM Security Trusteer uses AI and machine learning to authenticate customers, detect fraud and protect against malicious users on all digital channels. It can spot fraud in real time, assess identity risk and protect against malware so digital logins and transactions are secure. The service is designed to deliver a good customer experience while minimizing the risk of unauthorized access.