Question: Can you recommend a tool that automates monitoring and alerting across multiple data sources for fraud detection and risk management?

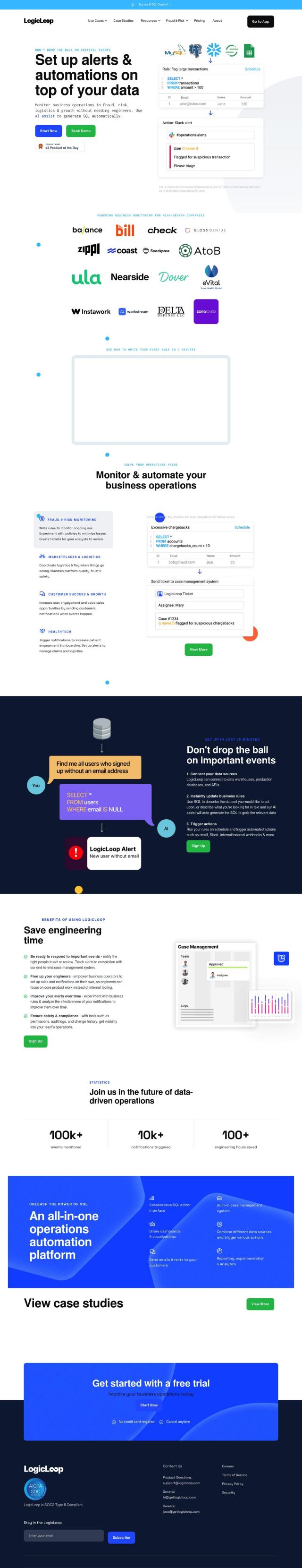

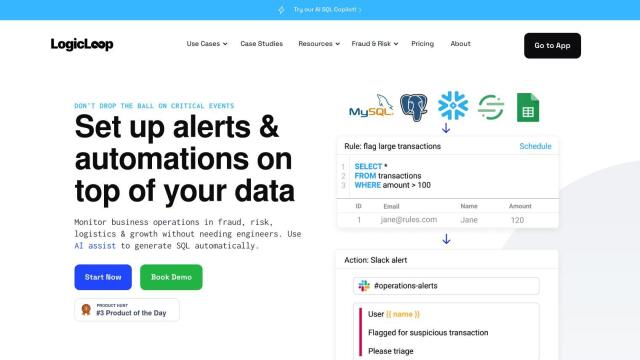

LogicLoop

If you're looking for a tool that automates monitoring and alerting across multiple data sources for fraud detection and risk management, LogicLoop could be a great option. It is a low-code SQL rules engine that allows companies to monitor data in real time from various sources like databases, data warehouses, and APIs. Features include AI-generated SQL queries, a collaborative interface, extensive integrations, and SOC2 Type II compliance, making it suitable for fraud monitoring and risk management.

Flagright

Another excellent choice is Flagright, an AI-native AML compliance and fraud prevention platform. It is designed for fintechs and banks, offering automated case management, AI-based risk scoring, real-time transaction monitoring, and a collaborative console. Flagright uses sophisticated AI algorithms to identify potential risks and improve compliance and fraud prevention, making it a robust solution for these specific industries.

Abacus.AI

For a more comprehensive AI platform, Abacus.AI offers a variety of features to build and run applied AI agents and systems. It includes products for fraud and security, predictive modeling, and anomaly detection, supporting automation of complex tasks and real-time forecasting. This platform is designed to make AI easier to add to applications, benefiting businesses in optimizing operations and predicting risks.

Observo

Finally, Observo is an AI-powered observability solution that can help in reducing security and observability costs while improving incident response times. It automates observability pipelines with features like anomaly detection, smart routing, and data enrichment, supporting over 50 sources and destinations. Observo is ideal for security or DevOps teams looking to optimize data management and improve productivity.