Question: I'm looking for a platform that allows me to finance my technology expenses and pay back over time to improve cash flow.

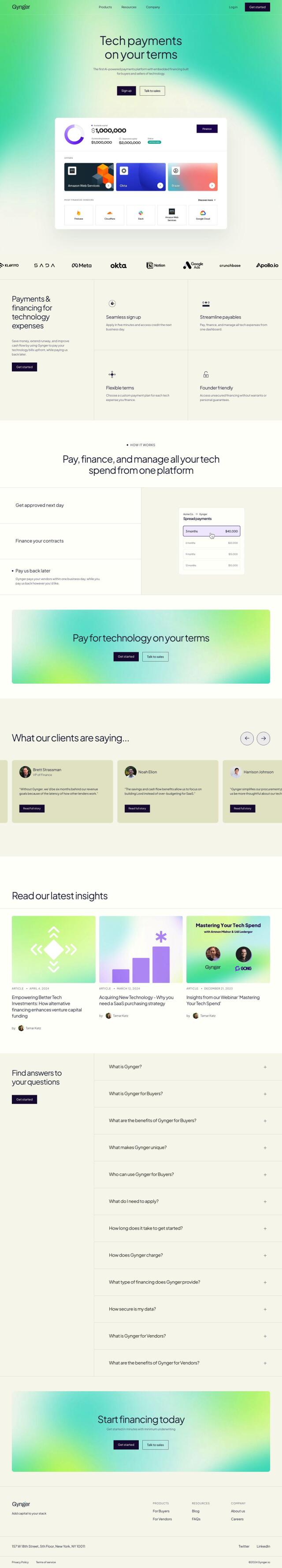

Gynger

If you're looking for a platform to fund your tech spending and repay over time, Gynger could be a good option. Gynger is an AI-powered payments platform that offers embedded financing for businesses buying technology. It lets you pay your tech bills now and repay the financing later, which can help you save money, extend your runway and improve cash flow. The platform offers a quick sign-up process, streamlined payables and flexible repayment options. Among its features is an easy-to-use dashboard to manage your tech expenses and founder-friendly financing with no interest rates or personal guarantees.

FinFloh

Another contender is FinFloh, which automates and optimizes accounts receivable (AR) processes. FinFloh helps businesses accelerate receivable collection, automate cash application, and make data-driven credit decisions. The platform offers customizable workflows, ML-based OCR for cash application, and AI-driven credit scoring. It integrates with ERP, CRM, and communication tools, with data security. The platform is designed for businesses that want to lower days sales outstanding (DSO), increase cash flow and improve collection efficiency.

Brightflow AI

If you want a more holistic cash flow management approach, check out Brightflow AI. The platform offers real-time financial insights, daily/weekly/monthly cash flow tracking and a single view of financial data from multiple sources. It can help businesses raise growth capital, manage cash positions and make data-driven decisions. Brightflow AI is designed for small to medium-sized businesses, streamlining financial operations and helping them make informed decisions to drive growth and profitability.