Question: I'm an early-stage investor looking for a platform that helps me find startups that fit my investment thesis, can you suggest something?

Accorata

If you're an early-stage investor seeking a platform to identify startups that match your investment strategy, Accorata is worth a look. This AI-powered deal sourcing platform lets you quickly screen deals from more than 30 online sources and even import pitch decks from your inbox. It has strong AI-augmented founder due diligence and is built with European data protection requirements in mind, so you can be confident in your data and the efficiency of the platform for early-stage investors.

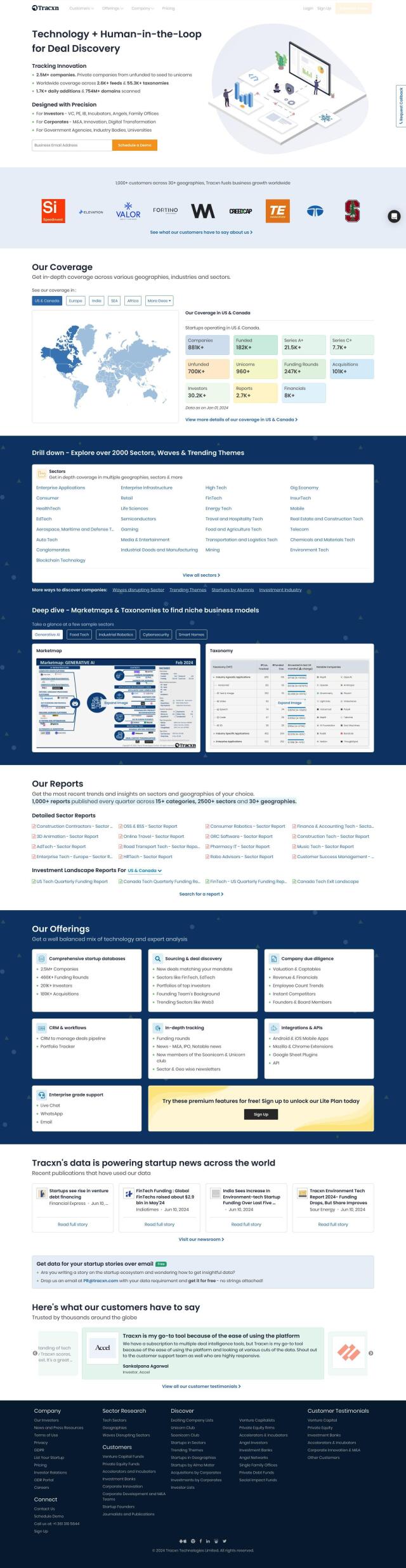

Tracxn

Another good option is Tracxn, which offers intelligence on startups and emerging markets. It tracks more than 2.5 million companies and offers features like startup databases, sourcing, company due diligence, CRM and workflows. If you want to track and analyze startups in more detail, you can generate reports and quarterly funding updates.

Novable

If you prefer a more sophisticated approach that combines AI with human expert evaluation, look at Novable. The platform offers in-depth analysis and vetting of startups, delivering ranked lists of relevant startups based on search briefings. Novable's AI technology is continually refined through user feedback, ensuring that the results are accurate and reliable.

CapitalConnector

Last, CapitalConnector can help you connect with startups and other parties through its large and accurate investor database. It offers AI-accelerated introductions and a lightweight CRM tool to manage follow-up, so you can focus on raising money and growing your business. It's good for investors of all levels who want to optimize their outreach.