Question: I'm looking for a service that provides comprehensive insights into assets and companies, can you recommend one?

AlphaSense

If you're looking for a full-service offering that offers insights into assets and companies, AlphaSense is a strong contender. The market intelligence platform uses AI and NLP to search a large library of more than 300 million documents, including company filings, broker research and regulatory filings. It offers real-time monitoring, market intelligence and enterprise-grade security, making it a good option for financial services companies, corporate strategy teams and healthcare companies.

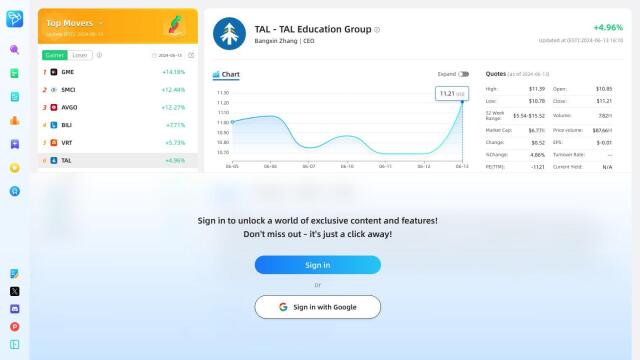

FinChat

Another good option is FinChat, an integrated research platform that marries institutional-quality financial data with conversational AI. It offers trusted financial data from S&P Market Intelligence and other sources, along with data visualization, DCF modeling and AI-powered competitor comparisons. FinChat offers a variety of pricing tiers, including options for individual investors, companies and financial services companies, so it can be adapted to suit different needs.

AlphaResearch

For those who want AI-powered document search and more advanced data analysis, AlphaResearch offers a more powerful platform. It indexes millions of filings from around the world and uses AI to extract insights from unstructured text. It's geared for institutional investors, retail investors and corporate strategists who want to get new insights and who want to save time on research. A basic plan offers access to the US market, and an enterprise plan offers global coverage.

Fintool

Last, Fintool is an AI-powered equity research copilot based on SEC filings, earnings calls and conference transcripts. It presents financial metrics in tables and offers real-time alerts on quantitative and qualitative data. Fintool is geared for institutional investors who want to ask complex questions and get precise answers. It can also be used to draft memos and reports with real-time data so you can be sure you're using the most current and accurate financial information.