Question: Is there a service that offers automated position monitoring and updates for options trading?

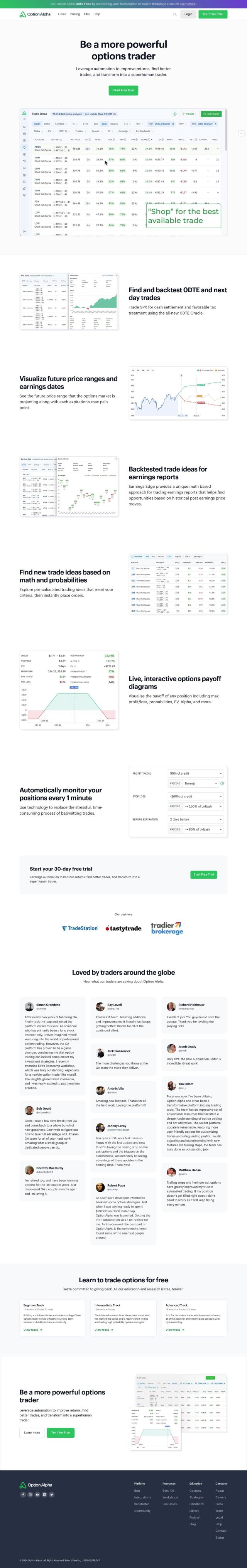

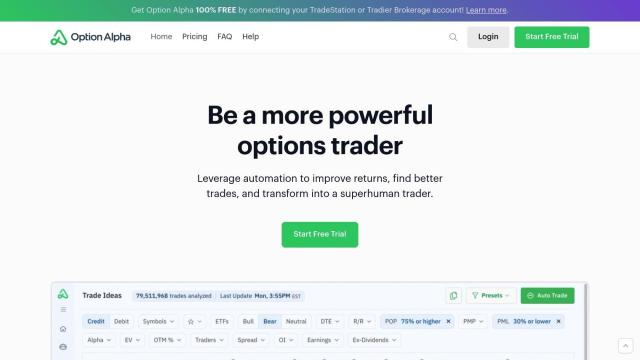

Option Alpha

If you're looking for a service that monitors your position and updates your options trades automatically, Option Alpha is definitely worth a look. The service offers a range of advanced tools, including live interactive options payoff diagrams, position monitoring and pre-calculated trading ideas. It's got three tiers of subscriptions with different limits on bots and backtests per month, so it's good for both casual and serious traders.

Tradytics

Another contender is Tradytics, which offers options flow data and AI-generated trading ideas. With its collection of tools -- including AI-fed news feeds, live options flow data and advanced analytics -- Tradytics can help you make sense of the trading data deluge and turn it into something you can act on. That could be particularly useful for retail traders who want to tap into market expertise that's out of their reach.

Praxis

For traders who want to use AI to fine-tune their approach, Praxis offers a trading journal that integrates with popular trading platforms. It offers real-time performance tracking, AI analysis and advanced journaling abilities so you can try different approaches and try to forecast market movements. It's geared for traders who want to keep their emotions in check and optimize their trading.

LevelFields

Last, LevelFields offers AI-based stock and options trading tools that speed up investment research by finding events that affect stock prices. It's got features like daily AI stock and options trades, event alerts and customizable watchlists so investors can find what they're looking for and stay up to date.