Question: I need a solution that can automate back-office work for my venture capital firm, including fund administration and portfolio insights.

Dili

For automating back-office work specifically for your venture capital firm, Dili is a highly recommended solution. It offers a comprehensive AI-powered platform for deal management and portfolio insights. Dili automates due diligence, generates private deal comps and benchmarks, and flags potential deal issues. It integrates data from various sources like Google Drive, Dropbox, and Pitchbook, ensuring you have a single source of truth without manual data entry. With SOC2 certification, it ensures data security.

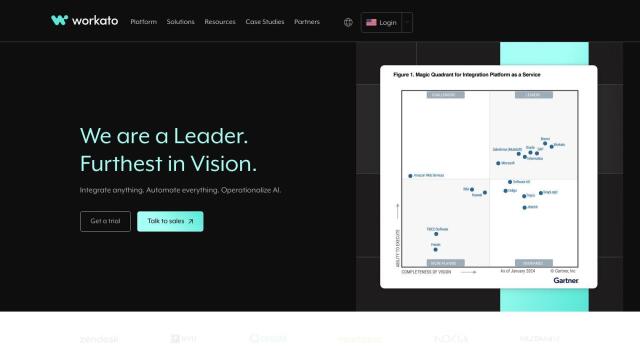

Workato

Another robust option is Workato, an automation platform that spans multiple applications and services. It offers over 1200 pre-built connectors and accelerators, making it easy to integrate and automate business processes across finance, HR, and other teams. Workato's AI capabilities democratize transformation and provide industry best practices, ensuring operational efficiency and security with end-to-end encryption. Its scalable architecture and flexible pricing make it a reliable choice for automating your venture capital firm's back-office work.

UiPath

UiPath is another excellent choice for automating various business processes. It uses AI and automation to enhance efficiency and productivity across different industries and departments. With features like process mining, document understanding, and integration services, UiPath can help streamline and automate tasks in your firm. It offers flexible pricing options and a range of resources, including training and customer support, to help you integrate automation smoothly.

VentureInsights.ai

For detailed investment and fundraising insights, consider VentureInsights.ai. This AI-powered platform provides tools for deal pipeline management, smart investor reporting, and portfolio benchmarking. It caters to both startups and investors, helping streamline fundraising processes and offering co-investment tools and LP management. VentureInsights.ai's features are designed to help you manage your portfolio efficiently and gain deeper investment insights.