Question: Is there a platform that offers a comprehensive trade log and emotional strategy mapping to help me manage my trading emotions?

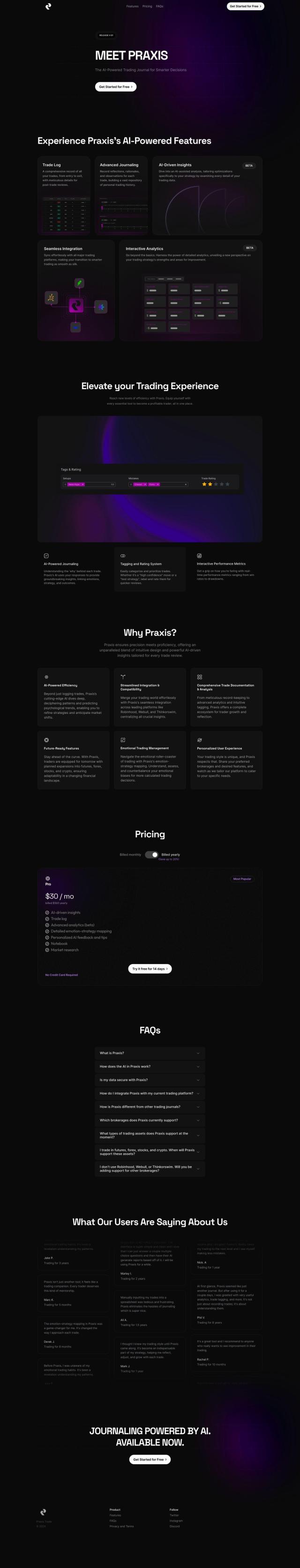

Praxis

If you want a full trade log and emotional strategy mapping, Praxis is a good option. Praxis is an AI-powered trading journal that integrates with popular trading platforms like Robinhood, Webull and Thinkorswim. It can record trades in detail, journal trades, perform AI analysis and offer interactive analytics to help you refine your trading strategy and manage your emotions. The Pro plan includes AI analysis, trade logs, emotion-strategy mapping and personalized feedback for $30 per month (billed annually at $360).

TradeLocker

Another good option is TradeLocker, a trading platform used by more than 2 million traders. It includes integrated charting with more than 100 indicators through TradingView, modernized trading interfaces and an AI-powered studio to convert trading ideas into automated trading strategies. TradeLocker also includes a detailed portfolio tracker, balance manager and real-time market scanner across assets like crypto, forex and indices. The service protects user data and privacy, so it's a good choice for traders.

Moodset

For a broader emotional management approach, Moodset offers an AI-powered mood tracking app. It uses the circumplex model to assess emotions and tracks moods through personal entries and automatically detected emotions based on music preferences. Moodset lets you record emotions on a visual mood map, explore emotional histories and create personalized playlists to influence your mood. The app is designed to help you develop self-awareness and learn to regulate your emotions, which can be useful for traders trying to keep their emotions from running wild during market ups and downs.

Tradytics

Finally, Tradytics offers an options flow data platform with AI-powered tools for retail traders. It offers premium options flow data, AI-generated trade ideas, advanced analytics and live options flow data. Tradytics is designed to make complex trading data more useful, which can help you make better decisions and manage your emotions when trading during volatile market conditions.