Question: I need a tool that connects to all my bank accounts and provides a complete view of my cash flow, can you suggest one?

Fortune App

If you want a service that links to all your bank accounts and offers a unified view of your financial situation, the Fortune App is a good choice. This AI-based accounting software automates, analyzes and forecasts your financial situation across multiple banks around the world. It links to more than 17,000 banks globally and offers features like instant transaction notifications, automated categorization and support for multiple currencies. The service is available on desktop, mobile and tablet computers, and has two pricing tiers.

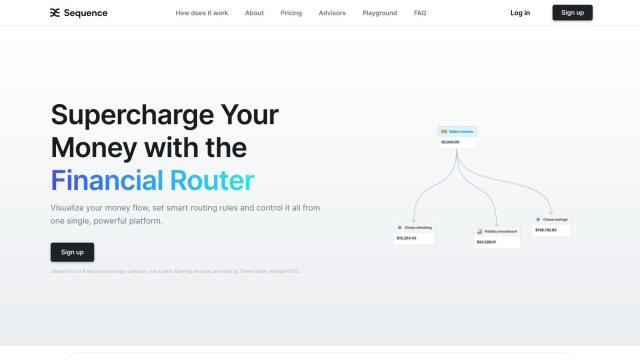

Sequence

Another good option is Sequence, a financial router that automates and visualizes financial management by linking multiple financial accounts, including checking and savings accounts, brokerage accounts, credit cards and cryptocurrency wallets. It includes a dynamic UI money map that offers a real-time view of your financial situation, with live updates to balance and notifications. You can also create custom automations with smart rules and IF statements to optimize savings and financial control.

Canua

Canua also offers a unified view of your financial life by tracking accounts, investments and taxes. It automatically imports and organizes data and offers a network of licensed financial professionals for advice and guidance. The service is designed to accommodate complex finances and links to more than 17,000 banks and brokerages, so it's a good option for people with multiple sources of income.

WeFIRE

If you're interested in AI-based services, WeFIRE offers personalized services to help you manage and optimize your financial situation. It offers detailed cash flow analysis, timely alerts and a FIRE Plan to track your progress and personalized budgets. WeFIRE also has security as a top priority with multi-factor authentication and encrypted connections to bank and brokerage accounts through Plaid.