Question: Do you know of a stock evaluation system that considers value, safety, and timing to reduce risk and maximize returns?

VectorVest

If you're looking for a more detailed stock assessment system that incorporates value, safety and timing, VectorVest is a good option. The service analyzes more than 16,000 stocks daily and offers buy, sell or hold recommendations based on its VST indicators. It's geared toward underpriced stocks with steady earnings growth, an approach designed to minimize risk and maximize profit. With daily stock recommendations, market timing signals and integration with various trading platforms, VectorVest is good for both beginners and more experienced investors.

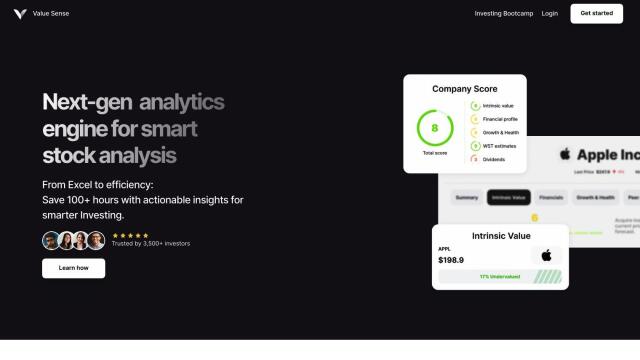

Value Sense

Another powerful option is Value Sense, which uses a next-gen analytics engine to deliver more advanced stock analysis. The service is geared for long-term investors who want to find undervalued and overvalued companies and generate high-quality returns. Value Sense scoring offers immediate assessments of company quality so you can build a portfolio strategy and make investment decisions.

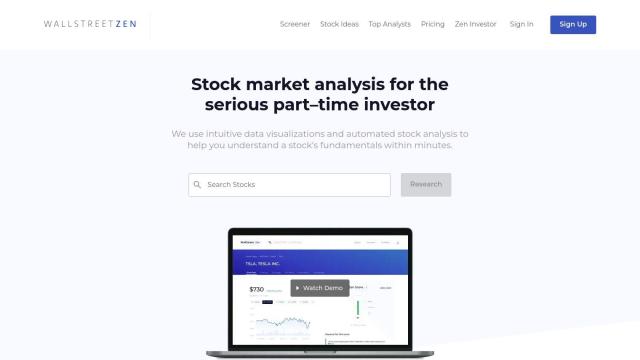

WallStreetZen

For part-time investors, WallStreetZen offers a data visualization and automated analysis system. It offers a Zen Score that evaluates stock fundamentals with 38 due diligence checks and offers analyst recommendations filtered by performance. WallStreetZen also offers a free stock screener and tracking of insider buying and selling, and is geared to help part-time investors avoid losses and improve returns.

TradeSmith

Last, TradeSmith is geared for individual investors who want to make data-driven decisions. It offers tools for portfolio management, risk assessment and automated buy and sell alerts. TradeSmith also offers tools like Quantum Edge Pro for quantitative analysis and daily newsletters with market analysis, so you can rebalance your portfolio and manage risk.