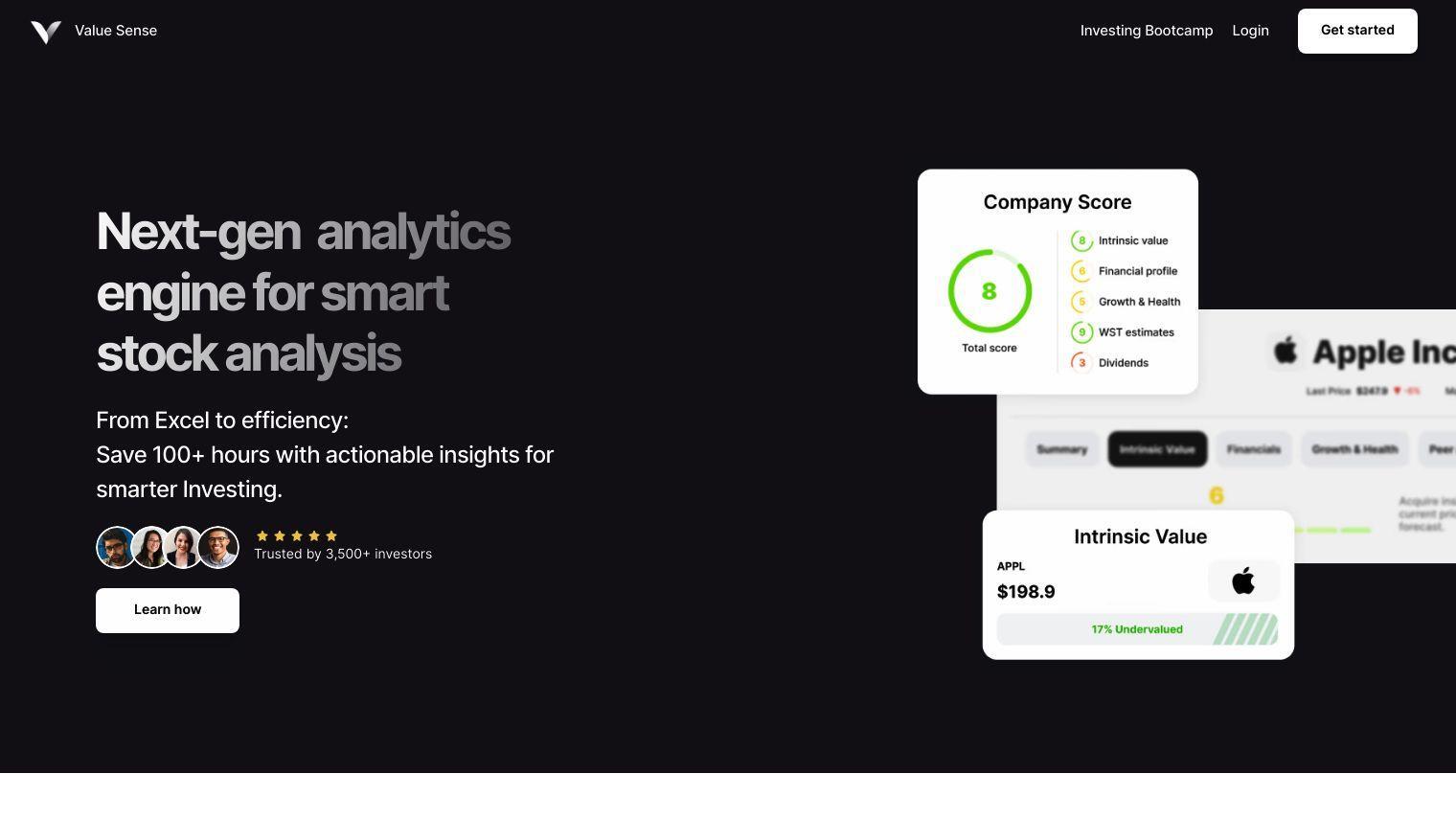

Value Sense empowers long-term investors to build wealth through smart investing, saving hours of research time and getting actionable stock insights. The service uses a next-gen analytics engine to provide smart stock analysis for individual, aspiring and professional investors.

Value Sense is designed to help retail investors and hedge funds get access to the same high-level tools and insights. It addresses the difficulties of developing a portfolio strategy for undervalued companies, finding long-term investment opportunities and finding undervalued stocks through historical intrinsic value analysis.

Some of its features include Value Sense scoring for instant company quality assessment, finding under/overvalued companies and generating high-quality returns for long-term wealth creation. The company says its Great & Undervalued US stocks index has outperformed the market by 12.8% per year since 2019.

Value Sense is geared for investors who want to develop a portfolio strategy, make informed long-term investment decisions and improve their existing strategy with advanced analytics and in-depth market knowledge. It's useful for a range of investors, from those just getting started with investing to those who want to beat the S&P 500.

Ready to start building wealth with smart investing? Check out Value Sense directly for more information and to join the community of over 3,500 value investors worldwide.

Published on June 14, 2024

Related Questions

Tool Suggestions

Analyzing Value Sense...