Question: I need a solution that enables me to run multiple trading algorithms simultaneously and monitor their performance in real-time.

QuantConnect

If you want a system that lets you run multiple trading algorithms at the same time and see how they're performing in real time, QuantConnect is a great option. The system lets you write and run trading strategies on multiple assets. It has point-in-time backtesting, parameter optimization and live trading with deployment to co-located servers in the same data center as major exchanges. You can also search and clone publicly shared strategies, so it's a good all-purpose tool for quants and engineers.

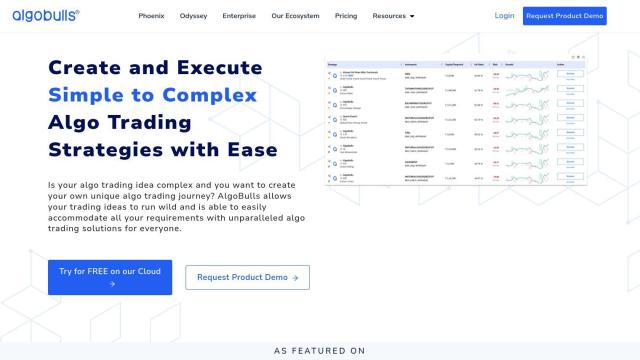

AlgoBulls

Another powerful option is AlgoBulls, a flexible system for building, executing and monitoring sophisticated trading strategies. It can trade on multiple exchanges and connect to brokers you've signed up with, and it's got features like generative AI to turn your trading ideas into code and a library of pretested strategy code. It's got tools for backtesting, paper trading and live trading, all through a user-friendly interface.

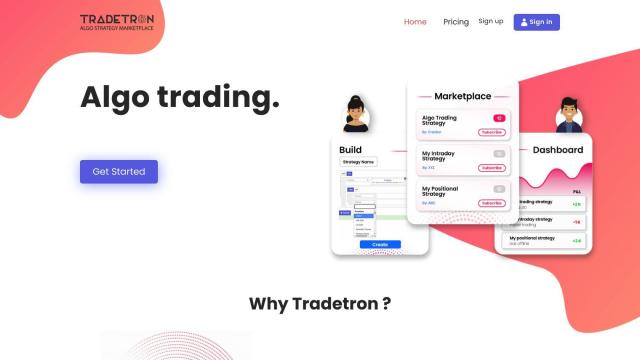

Tradetron

Tradetron is another option. The system lets you create, backtest and run algo trading strategies without writing any code. It's got a web-based strategy builder, backtesting engine, social trading and detailed reports to help you optimize performance. Tradetron offers a range of pricing tiers and can be integrated with existing trading infrastructure through a variety of broker APIs.

Alpaca

Last, Alpaca offers a powerful API-based system for adding trading to your apps. It offers stock, options and crypto trading and a range of tools like a test environment and a Broker API for end-to-end embedded trading. Alpaca is geared for sophisticated trading and investing, so it's a good choice for businesses and individuals who want automated trading and algorithmic trading.