Question: I need a tool that offers real-time analysis of metal prices to negotiate better deals with suppliers.

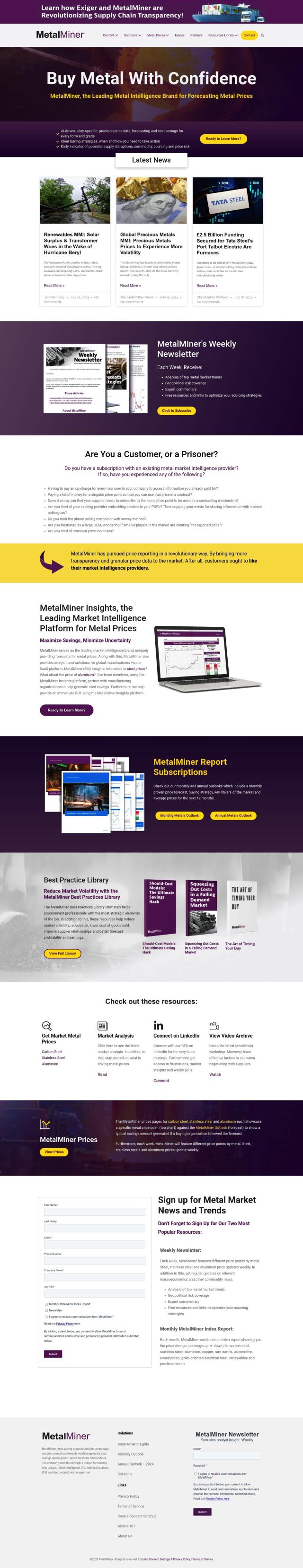

MetalMiner

If you're looking for a tool that will give you real-time analysis of metal prices so you can negotiate better deals with suppliers, MetalMiner is a good option. This SaaS service combines artificial intelligence, technical analysis and deep subject matter expertise to offer detailed price forecasts, should-cost models and sourcing strategy recommendations for a range of metals. It also comes with a weekly newsletter, best practices library and expert commentary to help manufacturers manage margins, smooth commodity volatility and find cost savings.

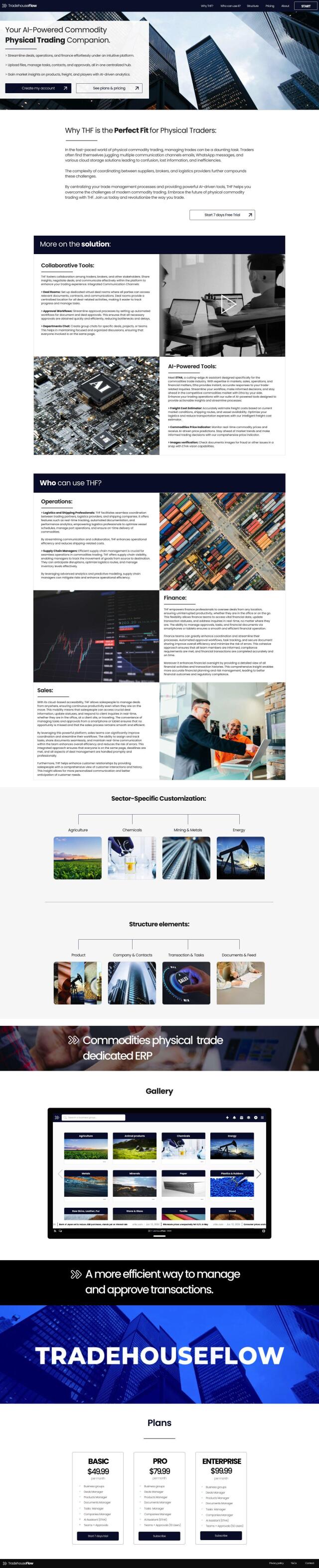

Tradehouseflow

Another option is Tradehouseflow, an AI-powered service to automate physical commodity trading operations. It lets you monitor commodity prices in real time and get AI-generated forecasts, so you can spot trends and make decisions. It also comes with a freight cost estimator and an AI-powered assistant for answering trade-related questions, so you can automate and streamline your commodity trading operations.

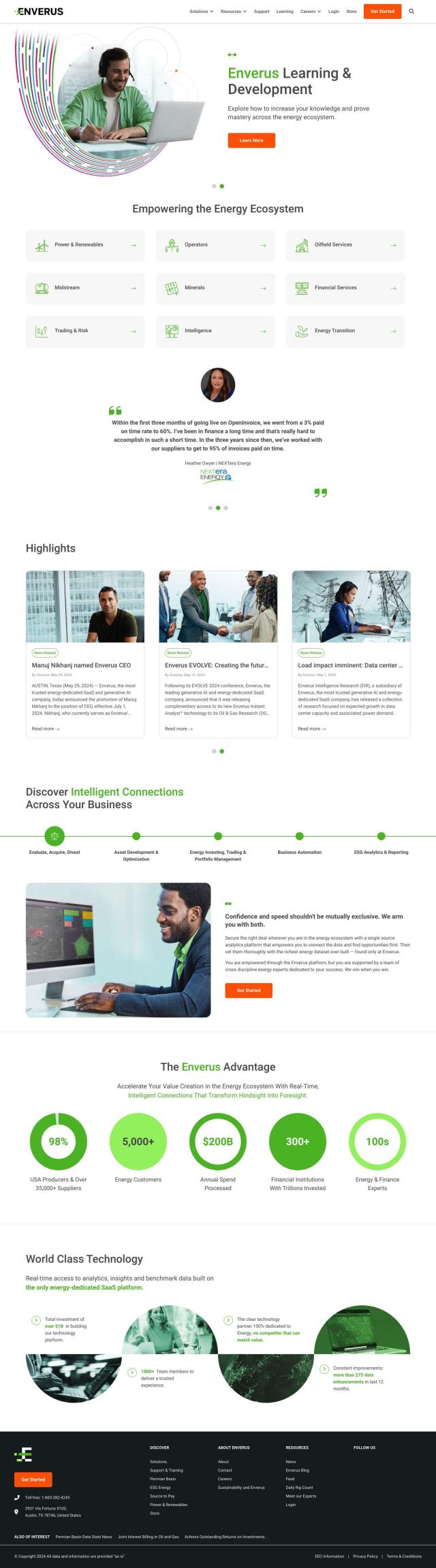

Enverus

For a broader view, Enverus offers real-time access to analytics, insights and benchmark cost and revenue data for the energy industry. It's geared for the energy industry, but its generative AI tools and scenario analysis tools can be used to analyze metal prices so you can make investment decisions and optimize your operations.

LSEG Data & Analytics

Last, LSEG Data & Analytics offers global market data, analytics and workflow tools to its customers. With real-time user-defined parameters and AI-powered analytics, it can provide detailed insights into metal prices so you can make better decisions and optimize your supply chain. The service's cloud-based infrastructure and wealth of data makes it a good option for managing and negotiating metal prices.