Question: I'm looking for a tool that helps me identify hidden risks and opportunities in the market, can you suggest something?

AlphaSense

If you're looking for a tool that can spot hidden risks and opportunities in the market, AlphaSense is a good option. It's a market intelligence and search platform that uses AI and NLP to scan a wealth of information, including company filings and broker research reports. With access to more than 300 million documents, you can monitor and track information in real-time. That can save a lot of time spent digging through documents and help you make data-driven decisions, making it a good option for financial services companies, corporate strategy teams and others.

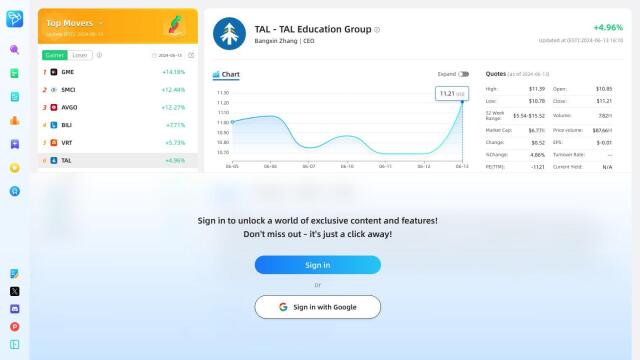

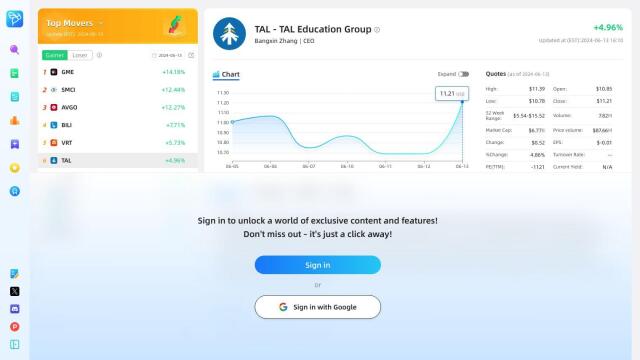

RAFA

Another good option is RAFA, an AI-based investment platform that offers a variety of tools to spot hidden risks and opportunities. RAFA includes AI agents like Analyst Pro, Options Guru and News Guru that can offer real-time portfolio alerts, daily investment ideas and portfolio risk analysis. It's geared for both beginners and experienced investors, so it's a good option for anyone looking to manage risk and make informed decisions.

AlphaResearch

For those who want to do more advanced data analysis, AlphaResearch offers a platform to extract information from unstructured text like company filings and earnings call transcripts. It also offers global institutional-grade fundamental data, market data, news and analyst estimates. With features like AI-powered document search and advanced data analytics, AlphaResearch is good for institutional investors, retail investors and corporate strategists who want to save time and get an edge.

Fintool

Last, Fintool is an AI-powered equity research copilot geared for institutional investors. It organizes financial metrics and unstructured data into tables and offers real-time alerts that can help you understand both quantitative and qualitative data. Fintool can draft memos and reports with real-time speed and auto-updating, so you can get the most accurate and up-to-date financial information from trusted sources, which can dramatically improve your equity research workflow.