Question: I'm looking for a funding solution that doesn't require giving up equity, can you suggest an alternative?

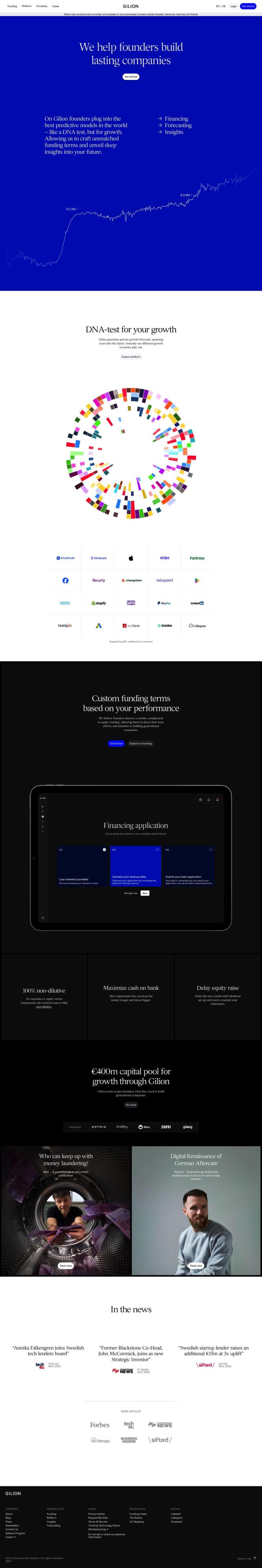

Gilion

If you're looking for a funding option that doesn't dilute your equity, Gilion is another option. Gilion offers customizable growth loans that are designed to give founders complete control over their company. The platform offers a 100% non-dilutive funding approach with a long repayment period and no warrants or equity return. This is particularly useful for businesses with recurring revenue and a customer base of at least 20.

Gynger

Another option is Gynger, which offers AI-powered payments solutions geared for companies that buy technology. Gynger lets companies pay their tech bills immediately and repay the financing later, which can help them save money and improve cash flow. The company offers flexible terms and founder-friendly financing with no personal guarantees or warrants, so it can be a good option for tech-exposed companies.

Slope

If you need more payment and order-to-cash automation, Slope offers flexible payment terms and embedded financing through APIs. Slope automates AR processes and offers net terms, installments and custom payment plans, freeing up customer order processing from manual labor. The company's platform works for a range of use cases, including B2B marketplaces and wholesalers, so it's a good option for companies that want to automate their financial operations.

Brightflow AI

Last, Brightflow AI is an eCommerce financial intelligence platform that helps companies manage cash flow and secure growth capital. It offers real-time financial insights and customized growth capital options, so business owners can make better decisions and drive growth. It's a good option for small to medium-sized businesses that want to simplify their financial operations and secure the best funding options.