Question: I need a solution that allows me to ask questions about financial trends and metrics and get detailed explanations.

Butter

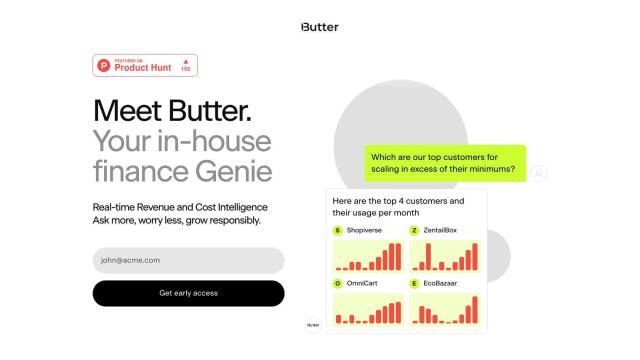

If you want a tool to ask questions about financial trends and metrics and get some explanation, Butter is a good choice. This financial intelligence platform aggregates data from sources like bank accounts, invoices and accounting systems into a single view, then offers query and analysis tools so you can ask questions and get answers about trends and metrics. That means people without a financial background can tap into financial data.

FinanceGPT

Another good choice is FinanceGPT, which uses generative AI and financial data to help investors, financial managers and accountants make decisions. It offers a variety of advanced tools, including monitoring of financial health, real-time data aggregation and customizable forecasting. With balance sheet analysis and profit and loss analysis, FinanceGPT offers insights through advanced analytics and expert knowledge.

Fintool

Fintool is another good choice, in particular for institutional investors. It offers detailed financial metrics and KPIs by parsing SEC filings, earnings calls and conference transcripts into tables. Real-time alerts and the ability to draft reports means it can be used to speed up equity research. Its enterprise-grade security and custom data upload means you can be sure the financial data it's providing is accurate and reliable.

Finpilot

If you want to go the AI route, Finpilot automates financial analysis workflows. It can quickly process data, answer specific questions and show trends. By automating data collection and analysis, Finpilot can free financial professionals to concentrate on higher-level analysis and decision-making, and deliver financial insights faster and more accurately.