Question: Can you recommend a software that consolidates financial data from multiple sources, including accounting software and ERPs?

Datarails

If you're looking for software that aggregates financial data from multiple sources, including accounting software and ERPs, Datarails is a good option. It automates data consolidation, financial reporting and budgeting and integrates with many common accounting software, ERPs and CRMs. Its features include data consolidation, financial reporting, budgeting and forecasting, along with AI-driven insights. It's used by finance teams in many industries and offers a custom pricing model to help you save time.

Syft

Another good option is Syft, a financial reporting tool that aggregates data from multiple accounting software, e-commerce platforms and ERPs. It offers customizable dashboards, consolidations that handle multiple currencies and automated inter-company eliminations. Syft integrates with accounting software like Xero, QuickBooks and Sage, and offers several pricing tiers, including a free Basic plan. It prioritizes data security with enterprise-grade protection, so it's a good option for accountants, businesses and non-profits.

Facta

Facta is another option. This financial data management software aggregates and automates financial data from multiple sources into a single data set without requiring a lot of programming. It offers a customized business intelligence solution for finance professionals, including aggregation, analysis and linking abilities. Facta is geared for people who use Excel, so you can quickly query and analyze data while keeping the copy/paste and keyboard shortcut abilities you're used to. It's good for private equity, venture capital, operators and advisors.

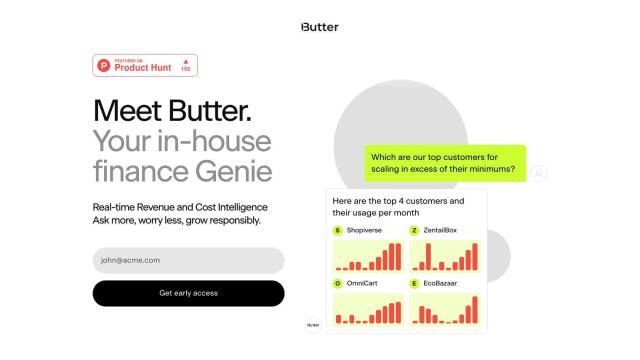

Butter

For a single view of business transactions, Butter aggregates data from bank accounts, invoices, accounting systems and vendor data. It offers data integration and query and analysis tools to help you understand trends and metrics. With customizable reporting, Butter makes financial intelligence accessible, helping businesses make informed decisions and grow responsibly.