Question: Is there a financial management app that offers cash advances with no interest or credit checks, and also helps me build credit?

Cleo

If you're looking for a financial management app that offers cash advances with no interest or credit checks and helps build credit, Cleo could be a good option. It's an AI-powered financial assistant that links to your main bank accounts for personalized budgeting and spending tracking. Cleo offers cash advances up to $250 with no interest or credit checks, and it includes tools to help you build credit. The platform also offers daily spend limits, low balance alerts, bill management and chat support, so you can stay on top of your finances. It's available for download on iOS and Android devices and offers subscription-based plans.

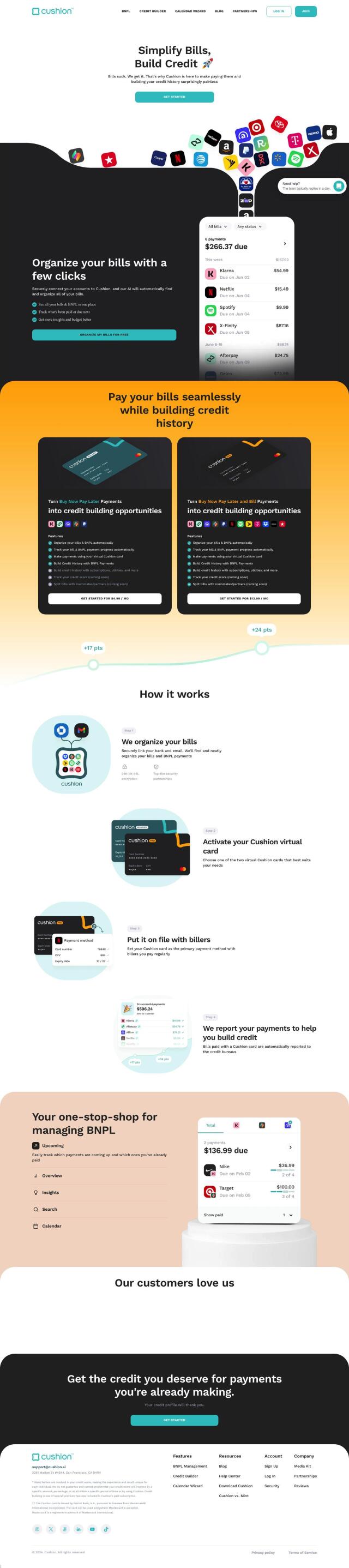

Cushion

Another option to consider is Cushion. The tool helps you organize bills and build your credit history by securely linking your accounts and giving you a single view of your financial obligations. Cushion offers features like bill organization, payment management through a virtual credit-building card, credit score tracking and calendar integration for payments. It also integrates with bank payment plans and converts them into credit-building opportunities, helping you improve your credit score over time.

TomoCredit

For those who need a credit-building service with no hard credit pulls, TomoCredit is an option to consider. TomoCredit uses alternative data sources and its proprietary algorithm to evaluate creditworthiness and offers tools to monitor credit and receive financial advice through an AI-powered chatbot. It offers a Tomo card with a 7-day automatic payment option and spending limits from $100 to $30,000. TomoCredit promises fast and easy approval without hurting your credit score, so it's a good option for those who want to build credit quickly.