Question: Do you know of a tool that offers diversified portfolio management without emotional biases?

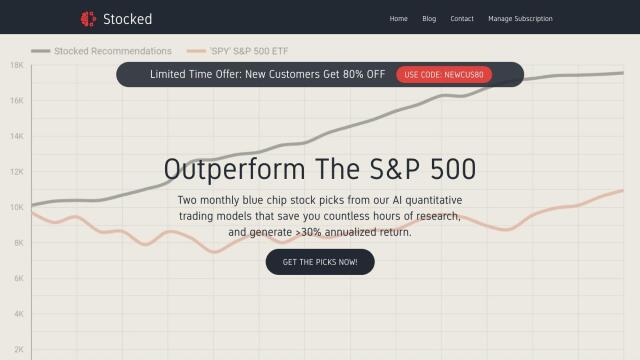

Stocked AI

If you're looking for a service that can manage a diversified portfolio without emotional decisions, Stocked AI is worth a look. The service uses AI quantitative trading models to generate monthly stock picks designed to deliver more than 30% annualized returns. It's designed for long-term growth, not for trading in and out of stocks, so the stock picks are made without emotional and irrational decisions. The service costs $49 per month or $495 per year.

Quantbase

Another good option is Quantbase, an SEC-registered robo-advisor service that offers automated investment portfolios and strategies that are typically available to hedge funds and quant hedge funds but now are available to ordinary folks. It requires a relatively low minimum investment and has no lock-ups, so you can get in and out when you want. Quantbase offers a variety of asset classes, including ETFs and cryptocurrencies. The service is transparent, with detailed information on each fund's performance and risk profile, so you can get a better idea of whether you're comfortable with the risks of some investments.

Mezzi

If you want a more complete investment management service, check out Mezzi. The service consolidates multiple investment accounts into one view, then uses AI to recommend changes to optimize your portfolio and cut fees. It offers features like personalized portfolio rebalancing, tax optimization, market and portfolio analysis, all designed to help you maintain a diversified and high-performing portfolio without emotional considerations.

Investipal

Last, Investipal offers a service to create and manage a personal investment portfolio with AI. It offers tools like AI Co-Pilot to research successful investments, Investment Inspiration to compare your portfolio with top performers, and Portfolio Analytics to track trends and manage risk. It's good for beginners and experienced investors, with different pricing tiers to suit different needs.