Question: I'm looking for a platform that allows me to backtest and optimize my trading strategies using large amounts of financial data.

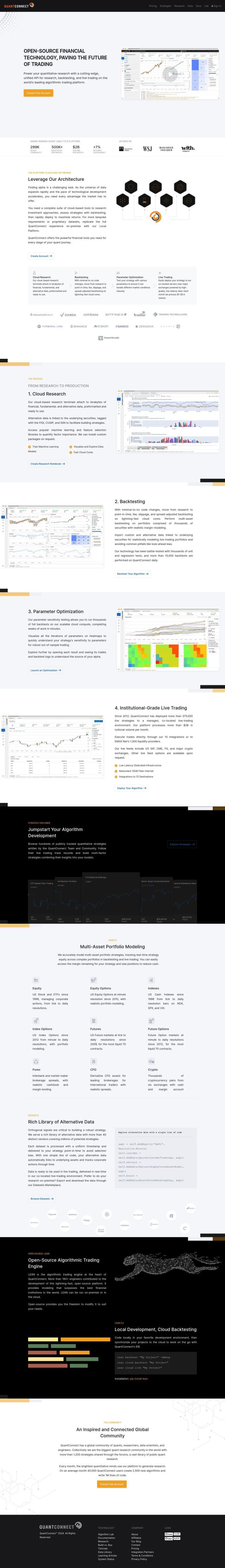

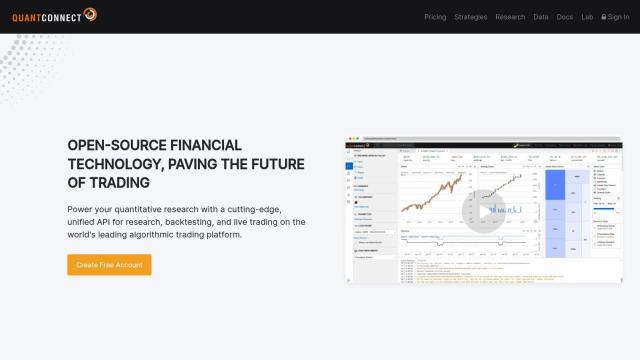

QuantConnect

If you want a full-fledged platform to backtest and optimize your trading strategies on massive amounts of financial data, QuantConnect is a top contender. It includes a collection of cloud-based tools for research, backtesting and live trading, including point-in-time backtesting with fee, slippage and spread adjustments and parameter optimization with cloud-computing scalability. With an extensive alternative data library and more than 40 vendors supplying millions of possible strategies, QuantConnect is geared for quants and engineers who want to create and run trading strategies on a variety of assets.

Tradetron

Another powerful option is Tradetron, a multi-asset, multi-currency and multi-exchange algorithmic strategy marketplace. Tradetron lets users create, backtest and run algo trading strategies without programming, with a web-based strategy builder and backtesting engine. It also offers social trading and execution algos, with detailed reports for optimizing strategy performance. It's good for both strategy creators and investors seeking a marketplace of vetted trading ideas.

WealthCharts

WealthCharts is a full-featured trading platform that marries AI technology with precise trading tools, good for traders of all levels. It includes tools for backtesting, strategy creation, options trading, futures trading with a DOM, and paper trading. With a library of more than 200 technical indicators and proprietary scanners, WealthCharts offers in-depth analysis and fine-tuning of trading strategies. It also offers educational content and multiple broker integration options.