Question: Can you recommend a solution that provides a library of tested and validated algo trading strategies to save time and effort?

AlgoBulls

For a library of tested and validated algo trading strategies, AlgoBulls is a full-featured platform. It caters to all skill levels with a range of tools, including generative AI, a library of strategy code and support for trading on multiple exchanges. The platform has features like backtesting, paper trading and live trading, all accessible through an interface that's easy to navigate. Pricing tiers range from a free Starter Python Build Plan to more advanced options, so it's good for both retail and enterprise customers.

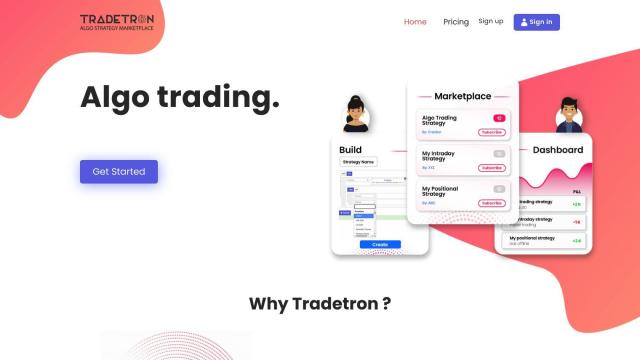

Tradetron

Another good option is Tradetron, a multi-asset, multi-currency, multi-exchange algorithmic strategy marketplace. It lets you build, backtest and execute trading strategies without having to write any code, and it's got features like a web-based strategy builder, backtesting engine and social trading. You can monetize your trading ideas and tap into a marketplace of vetted strategies, so it's good for both implementation and optimization.

Kvants

If you're interested in AI-powered quantitative trading strategies, Kvants matches you with AI-powered strategies from top hedge funds. The platform offers a variety of trading strategies, API trading and a variety of ecosystems, including CeFi, OmniChain and DeFi. With institutional-grade due diligence and personalized recommendations, Kvants can help you earn passive risk-adjusted returns and diversify your crypto holdings.

Composer

Also worth a look is Composer, a user-friendly platform that uses AI to create and execute trading strategies based on your goals and risk tolerance. It's got prebuilt strategies, a natural language-based editor for creating your own, and automated trading and rebalancing. With integration with retirement accounts and premium customer support, Composer is a good option for automated trading without having to write any code.