Question: I'm looking for a tool that helps me create and test my own trading strategies without needing to know how to code.

Composer

If you want a tool to design and test trading strategies without having to write code, Composer is a good choice. The service uses AI to construct and execute trading strategies based on your objectives and risk profile. It has a natural language-based editor to design strategies, automates trading and rebalancing, and comes with prebuilt strategies you can modify. The service connects to retirement accounts and offers premium and free tiers, so you can use it for different purposes and budgets.

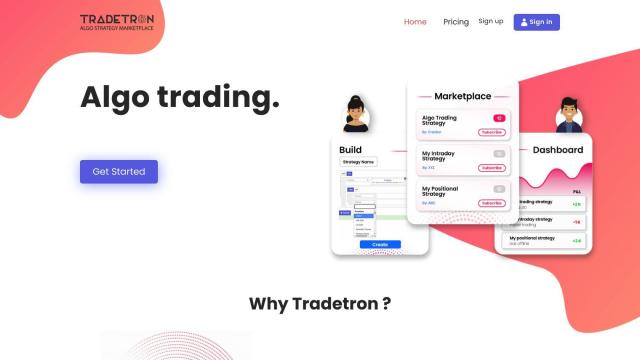

Tradetron

Another good option is Tradetron, a multi-asset, multi-currency and multi-exchange algorithmic strategy marketplace. You can design, backtest and execute algo trading strategies without writing any code. The service includes a web-based strategy builder, backtesting engine, social trading and execution algos. Tradetron supports a variety of broker APIs for easy integration and offers different pricing tiers for different needs, so it's a good option for algorithmic trading strategy execution.

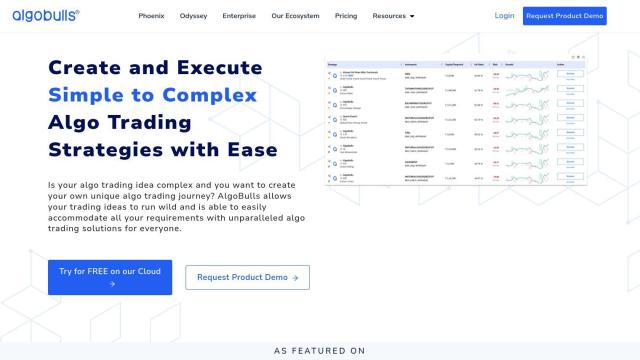

AlgoBulls

If you want more advanced features, AlgoBulls offers a powerful system for designing, executing and monitoring sophisticated trading strategies. It offers generative AI to turn trading ideas into code and a library of prewritten strategy code for both do-it-yourself and no-code options. The service offers detailed backtesting, paper trading and live trading options, so it's good for people with some experience.

Algorooms

If you want a service that offers a broad range of features with AI-powered tools, check out Algorooms. The service offers automated trading, strategy creation and social trading. It also offers backtesting with different scenarios and reporting consoles. Algorooms is geared for both beginners and experienced traders, with a range of options to automate trading and improve investment choices.