Question: I need a system that can help me manage risk and improve combined ratios in the reinsurance industry.

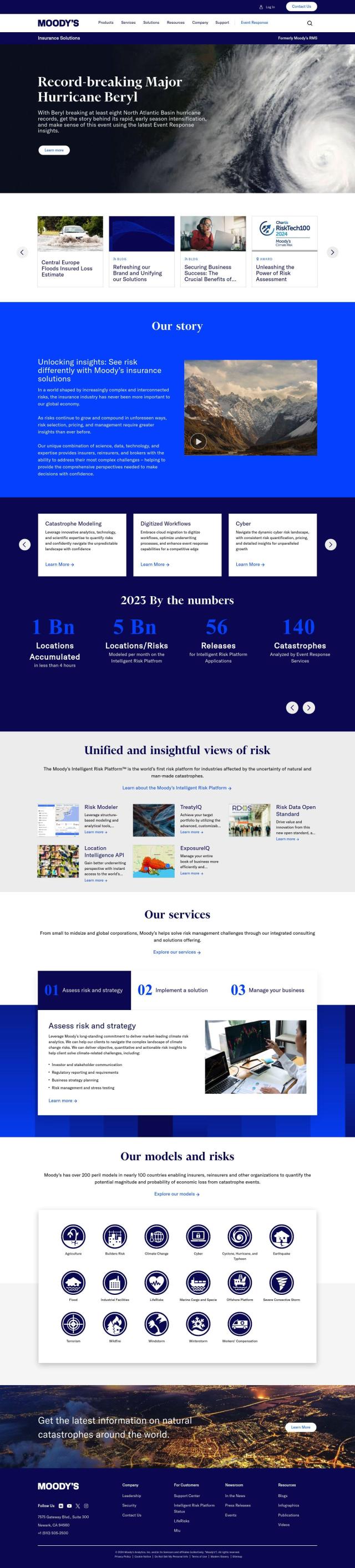

Moody's RMS

If you're looking for a more mature risk management system geared specifically for the reinsurance industry, Moody's RMS has a powerful data, model and expertise-based risk management system. It includes tools like Risk Modeler, TreatyIQ and ExposureIQ that offer advanced model processing, flexible pricing and efficient exposure analysis. The system accommodates a broad range of risk models and offers consulting and implementation services for climate risk analytics, business strategy development and regulatory reporting.

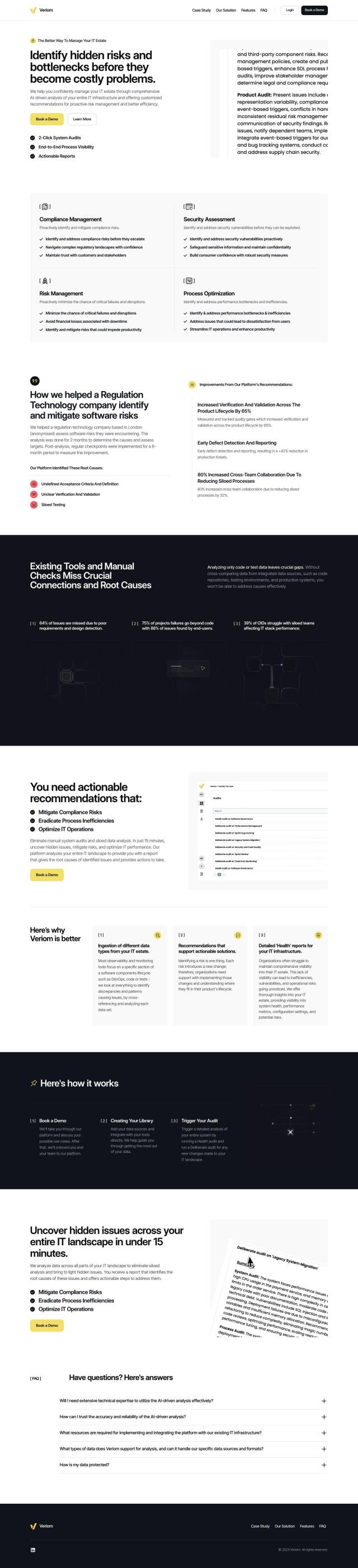

Verisk

Another strong contender is Verisk, a data analytics partner to the global insurance industry. Verisk offers a broad suite of tools and services to improve the insurance value chain, including new program development, data reporting efficiency and risk assessment. It offers specific solutions for reinsurance, underwriting and claims management, using AI-powered risk modeling and advanced analytics to help insurers make more informed decisions and drive growth.

Quanata

If you prefer a more modern, tech-savvy approach, Quanata offers an AI-powered platform for contextual risk prediction and mitigation. It includes real-time telematics and risk-based acquisition innovations so insurers can better predict risk and mitigate it through digital experiences. This cloud-native solution is designed to deliver more accurate risk insights and positive behavior changes for both insurers and policyholders.

Insurity

Last, you should look at Insurity, a cloud-based insurance software company with a comprehensive platform for policy, billing and claims management. Insurity's platform includes AI-powered insights and a cloud-native architecture that spans the entire insurance life cycle. It's been recognized for strong financial performance and market position, making it a trusted option for managing emerging risks effectively.