Question: Is there a platform that offers real-time market data and alerts for margin calls and stop-outs to help me manage risk?

TradeLocker

If you're looking for a platform that provides real-time market data and margin call and stop-out alerts to help you manage risk, TradeLocker is a good option. It has a familiar interface for tracking your portfolio, managing your balance and exploring markets in real-time for crypto, forex and indices. It also has margin call and stop-out alerts so you can keep an eye on your positions and adjust accordingly. It also lets you automate trading with its AI-driven Studio and protect data with encryption.

LSEG Data & Analytics

Another good option is LSEG Data & Analytics, which offers global market data, analytics and workflow solutions. It has real-time user-defined parameters, AI-driven analytics and broad cross-asset data. It's designed for a range of users, including wealth advisors and portfolio managers, and integrates with Reuters news and offers intuitive predictive discovery tools. The LSEG Workspace ecosystem is customizable for different types of users, offering a personalized environment for sustainable growth.

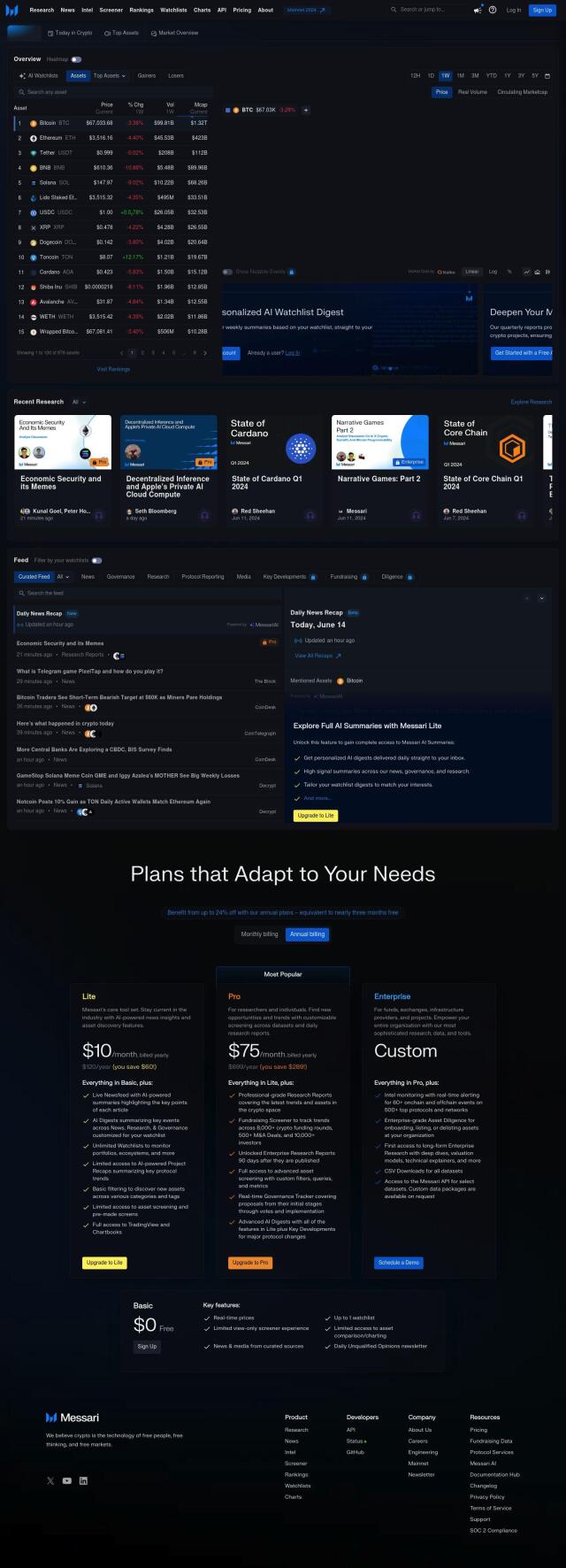

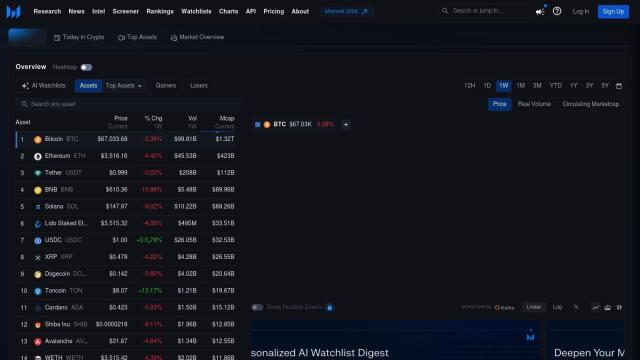

CryptoQuant

If you're a cryptocurrency enthusiast, CryptoQuant offers a powerful on-chain and market analytics platform. It offers real-time alerts, proprietary metrics and customizable analytics tools. You can create your own metrics, build interactive dashboards and track a range of market indicators, making it good for trading and risk management. It offers a range of pricing tiers, including a free plan, so it's good for institutional and professional users at different levels.

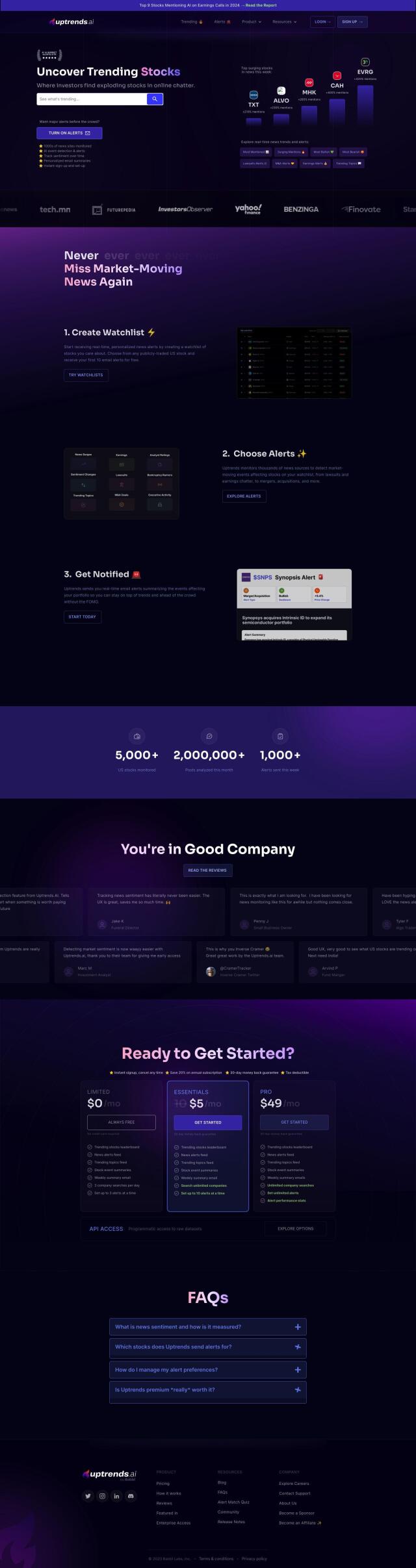

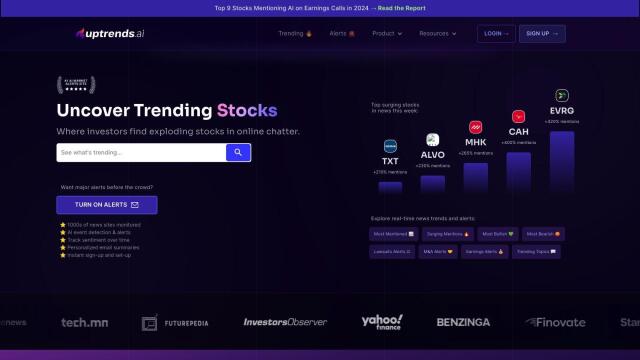

Nansen

Last, Nansen is another good option for crypto investors. It offers real-time insights and alerts based on onchain data tracking and powerful no-code analytics. The platform offers portfolio management, wallet labeling and access to professionally researched insights through the Nansen Research Portal. It offers a range of pricing tiers, including a free plan, so it's good for anyone looking to make more informed crypto investment decisions.