Question: I'm looking for a personal finance tool that can help me manage multiple accounts and investments in one place.

Canua

If you're looking for an all-purpose personal finance tool that can handle multiple accounts and investments, Canua is a great option. It provides a single interface for your financial life, tracking accounts, investments and taxes. It can automatically import and categorize data to give you a unified view, and it can also file FBAR reports automatically and link to data from more than 17,000 banks and brokerages. The company also has a network of licensed financial advisors who can help and advise, so it's good for people with more complicated finances.

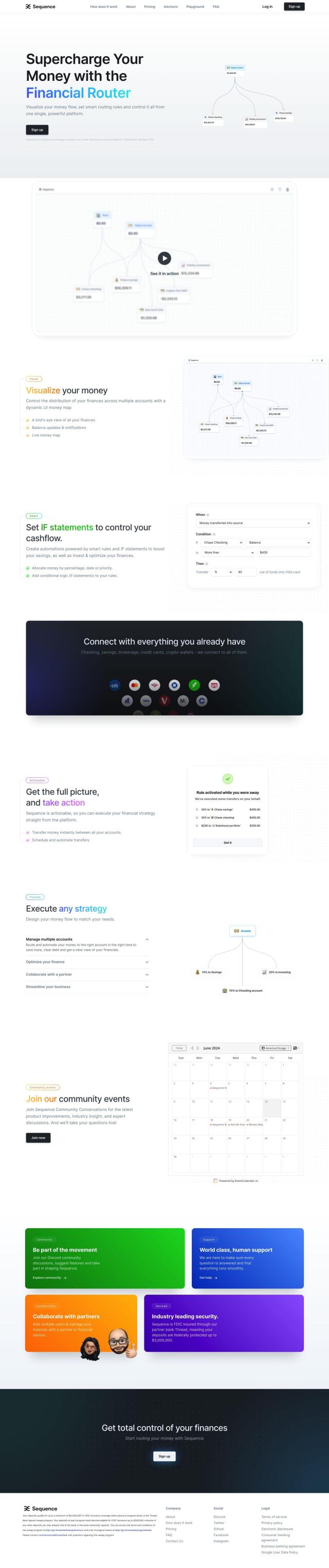

Sequence

Another strong contender is Sequence, a financial router that automates and visualizes your financial life. It can link multiple financial accounts, including checking and savings accounts, brokerage accounts and cryptocurrency wallets, and it presents a dynamic UI money map that updates in real time. You can set up custom automations and smart rules to fine-tune your finances, and the company protects your data with industry leading security, including FDIC insurance up to $3,000,000.

Parthean

Parthean is another powerful option, with AI-driven financial management that automates savings, investments and debt repayment. It also offers round-up savings, real-time insights and spending tracking. Parthean protects your data with bank-level encryption and doesn't sell your data, so it's a good option for those who want a comprehensive and secure way to manage their finances.

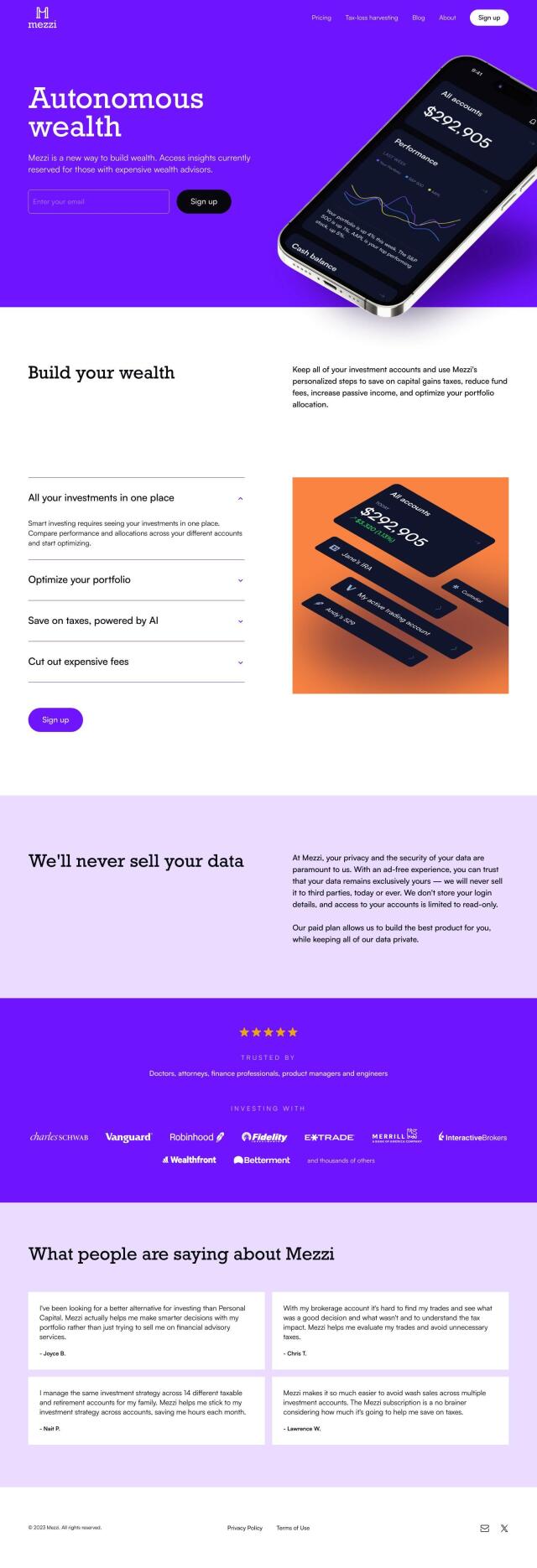

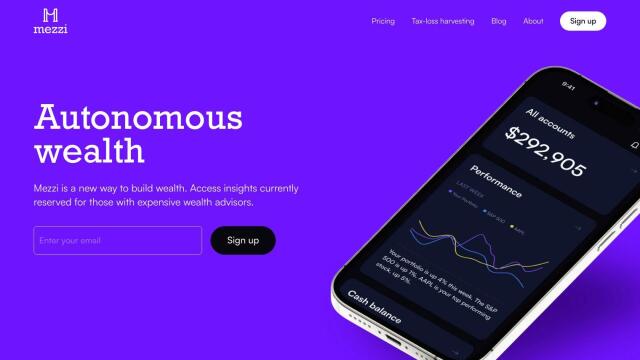

Mezzi

If you're more interested in investment management, Mezzi is a good option. It can link multiple investment accounts into one view, and it offers AI-driven recommendations to optimize your portfolio and cut fees. Features include personalized portfolio rebalancing, tax optimization and market and portfolio analysis, so it's a good option for those who want to maximize their investment returns while keeping their taxes in mind.