Question: I need a PCI-compliant solution to scan credit cards in my mobile app, what options are available?

Microblink

If you're looking for a PCI-compliant way to scan credit cards in your mobile app, Microblink is a good option. It's got a range of products, including BlinkCard for credit card scanning, all designed to make sure the experience is as smooth as possible for users. Microblink has industry leading support with 2,500+ identity documents from 140+ countries and is certified with ISO/IEC standards for data protection.

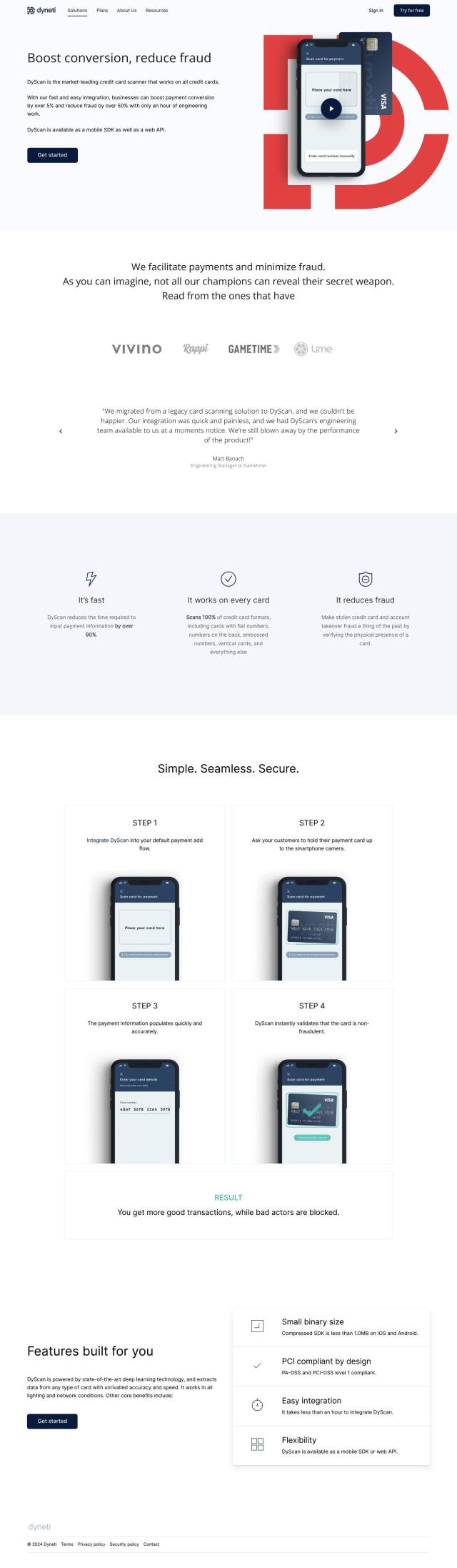

DyScan

Another good option is DyScan, a credit card scanning SDK that uses deep learning technology for high accuracy and speed. It's PCI compliant and can be integrated in less than an hour with a mobile SDK and web API. DyScan offers high accuracy and fraud prevention, making it a good option for businesses of all sizes looking to improve their payment experience without sacrificing security.

Basis Theory

If you're looking for a more complete solution, you might want to check out Basis Theory, a programmable vault platform for managing commerce flows and compliance data. It comes with SDKs for integration with a variety of platforms and supports PCI Level 1 compliance, HIPAA, and ISO 27001. Basis Theory offers flexible payment flows and a secure data vault, so developers and businesses can build customized payment experiences that are both secure and efficient.

Wibmo

Finally, Wibmo offers secure online payment solutions for banks and fintechs, with a focus on payment security, fraud prevention and authentication. It supports a variety of use cases, including prepaid cards and wallets, and processes over 3 billion transactions per year. Wibmo's suite of solutions is designed to help financial institutions accelerate go-to-market strategies and drive innovation while ensuring the highest level of security and efficiency.