Question: I'm looking for a tool that helps me refine my options trading strategy with automation and backtesting.

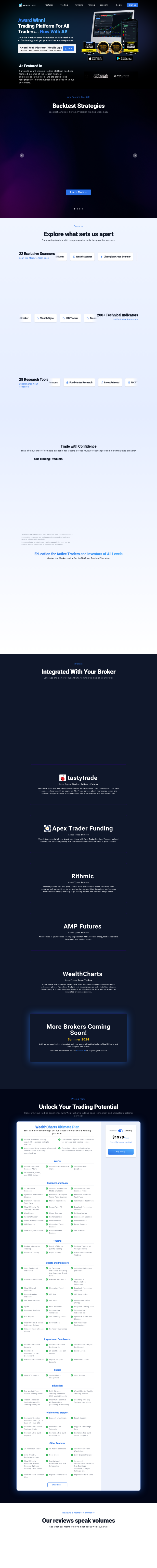

Option Alpha

If you want to automate and backtest your options trading strategy, Option Alpha is definitely worth a look. It's got a powerful automation system geared for options traders, with tools like the 0DTE Oracle for backtesting and finding 0DTE and next-day trades, price range and earnings date charts, and automated position monitoring. The service also offers pre-calculated trading ideas and live interactive options payoff diagrams. With different pricing tiers and free tutorials, Option Alpha is designed to help you get more out of your trading.

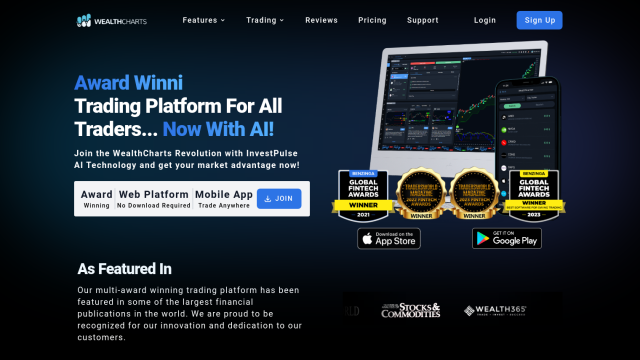

WealthCharts

Another interesting option is WealthCharts. It marries AI technology with precise trading tools so that traders of all skill levels can tweak their approach. The service includes backtesting, strategy builder, options trading platform, futures trading DOM and paper trading. It also has a library of proprietary scanners and more than 200 technical indicators for a deeper look. WealthCharts offers tutorials and multiple integration options with brokers, so it's a good choice for serious chartists.

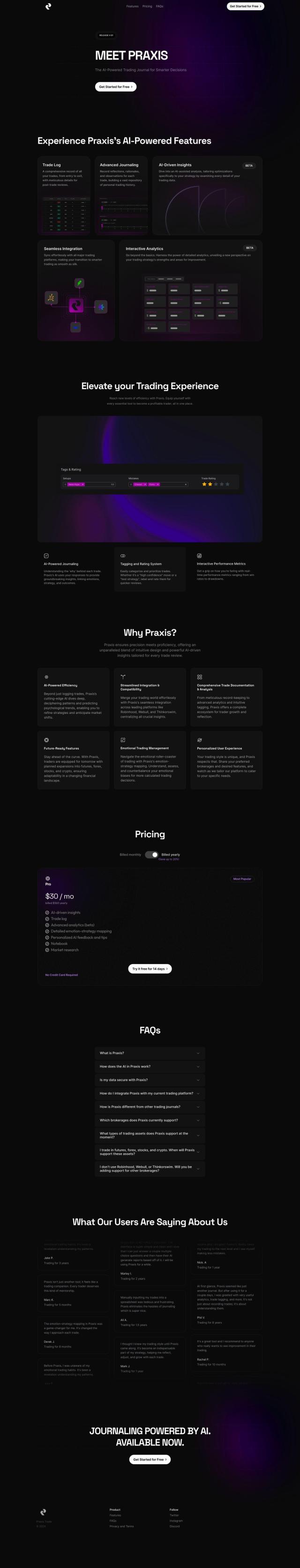

Praxis

If you want to marry your trading journal with AI analysis, Praxis is also worth a look. It can link to popular services like Robinhood, Webull and Thinkorswim, and offers advanced journaling, AI analysis and real-time performance tracking. Praxis also has emotional trading management tools and AI pattern recognition, which can help you optimize your trading strategy and predict market shifts.

Tradytics

Last, Tradytics offers a different set of tools for retail traders, including access to premium options flow data, AI-powered news feeds and advanced analytics. The service is designed to try to bridge the gap between retail traders and institutional investors by making otherwise complex trading data more actionable. With different pricing tiers and resources like crash courses and YouTube tutorials, Tradytics can help you make better, data-driven trading decisions.