Question: I'm looking for a platform that helps financial institutions manage partnerships and affiliates while ensuring brand safety and compliance.

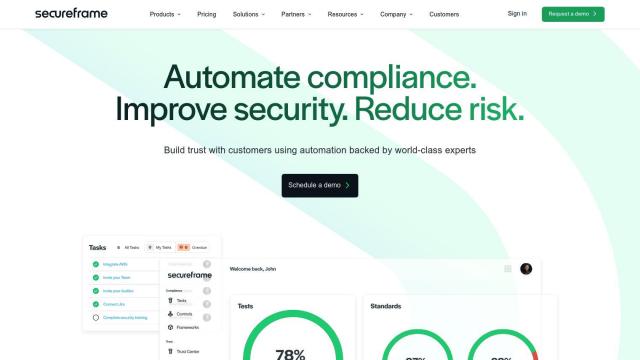

Fintel Connect

If you're looking for a platform to manage partnerships and affiliates while ensuring brand safety and compliance in the financial services industry, Fintel Connect is an excellent choice. This partner marketing platform offers a comprehensive solution for financial institutions, providing tools for partner management, content compliance, and customer journey tracking. With access to a vetted network of over 4,000 finance-focused affiliates and influencers, Fintel Connect helps scale growth efficiently while maintaining brand compliance, offering average savings in acquisition costs of 70%.

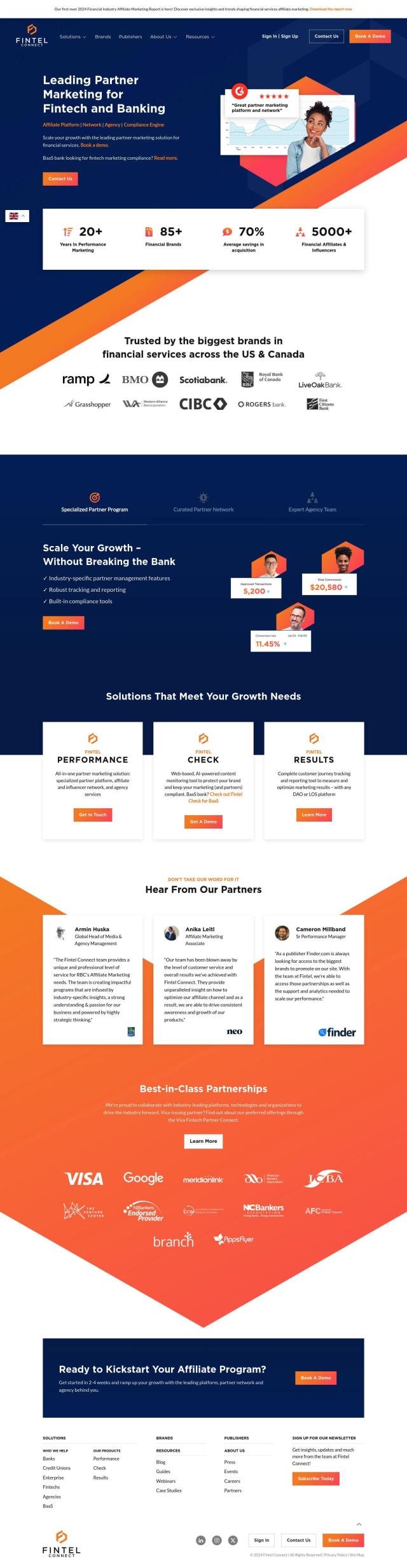

Affistash

Another noteworthy option is Affistash, an AI-powered affiliate recruitment and management system. Affistash automates the discovery of potential partners and provides detailed analytics to understand each partner's audience. It offers a full CRM portal to manage campaigns and track relationships, making it easier for businesses to find and manage effective partnerships. This can significantly streamline and enhance your affiliate recruitment and management efforts.

Allbound

For a more holistic approach to partner relationship management, consider Allbound. This platform streamlines partner acquisition, engagement, and ecosystem growth through automation. It offers a central partner hub, a content library, journey planning, co-marketing, and reporting capabilities. With integrations to popular systems like Salesforce and HubSpot, Allbound helps businesses automate routine interactions, improve partner performance visibility, and drive revenue growth.

LexisNexis Risk Solutions

Lastly, LexisNexis Risk Solutions provides a suite of financial crime compliance and risk management tools. It offers advanced analytics and AI technology to provide a comprehensive view of customer and third-party risk. The platform includes features like Customer Identification Program, Customer Due Diligence, and Watchlist Screening, making it ideal for financial institutions looking to enhance their workflows and comply with global financial crime regulations.