Question: Do you know of a tool that offers objective and audited insights into a company's financial health and long-term strategy?

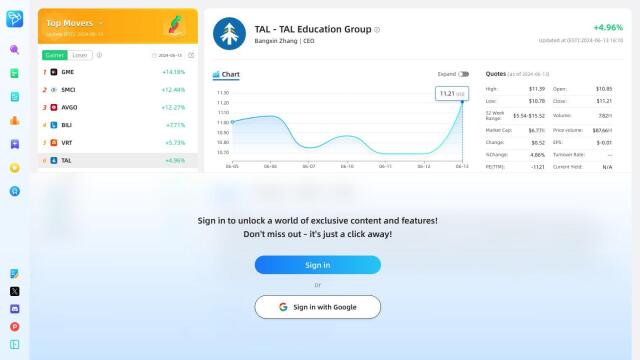

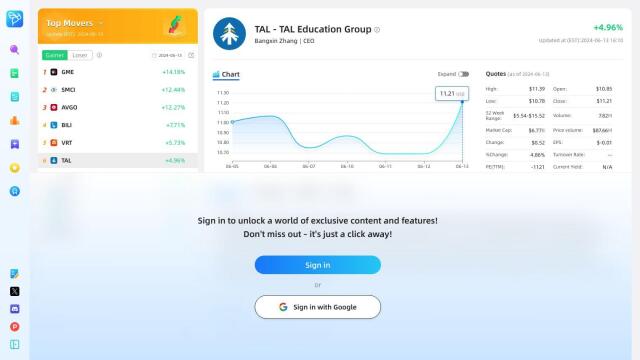

BeeBee AI

If you're looking for tools that provide objective and audited insights into a company's financial health and long-term strategy, BeeBee AI is a good option. This system uses AI to automate investment analysis with daily rankings and analysis of earnings reports, news and earnings calls. It includes detailed information across six modules, including risks and opportunities, summary, key numbers, analysts' questions, sentiment, and strategies. The tool is designed to give investors an objective and audited view of a company's financial health, operational state, and long-term strategy.

FinanceGPT

Another tool worth considering is FinanceGPT, which uses generative AI and financial data to create advanced financial analysis tools. It can aggregate real-time data, monitor financial health and forecast with customizable models. With 14 financial analysis tools, including balance sheet analysis, cash flow analysis, credit analysis and more, FinanceGPT can help you make better financial decisions. It can be particularly useful for complex financial situations and data-driven decision making.

AlphaSense

For those looking for a market intelligence platform, AlphaSense is an option. It uses proprietary AI and NLP technology to quickly search through a large library of company filings, broker research, expert calls and regulatory filings. The service can be used to monitor and track information in real-time, making it useful for data-driven decision making. AlphaSense is used by financial services firms, corporate strategy teams and consulting firms.

Fintool

Last, Fintool is an AI-powered equity research copilot that organizes financial metrics and KPIs into tables, including data types such as balance sheets, income statements, financial ratios and cash flows. It can send real-time alerts, help draft memos and reports, and ensure the most accurate and up-to-date financial information from trusted sources. It can be particularly useful for institutional investors looking to enhance and accelerate their equity research workflow.