Question: I'm looking for a financial data management tool that can consolidate data from multiple sources into one unified dataset.

Facta

If you're in the market for a financial data management tool that can pull information from different sources into one cohesive data set, Facta could be a good fit. Facta automates financial data consolidation from sources including financial, revenue and SaaS data into one data set. It offers a customized business intelligence solution with data aggregation, analysis and linking abilities, and is geared for finance people who are comfortable with Excel. The software also offers better accuracy and consistency with direct access to verified data.

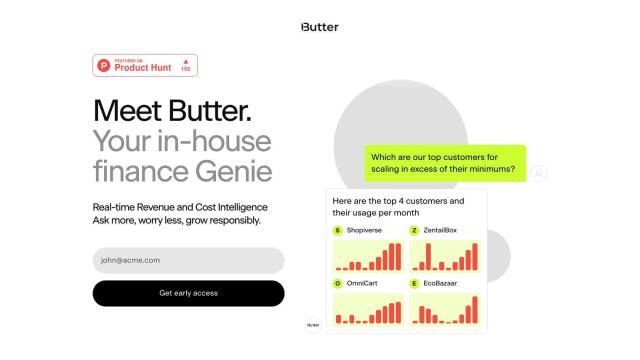

Butter

Another good option is Butter, a financial intelligence platform that pulls data from different sources like bank accounts, invoices and accounting systems into one view. It offers data integration, query and analysis tools, as well as customizable reporting. Butter is designed to bring financial data to nonfinancial people so they can make decisions and run their business responsibly.

Arch

For a more complete solution, check out Arch, an end-to-end data platform that streamlines operations and speeds up decision making. It offers SQL and API access, a semantic layer for unified data modeling, and customizable templates for data ingestion. Arch pulls data from multiple systems into one view of key metrics, so it's good for businesses that have a lot of customers and don't want to build a lot of infrastructure.

Datarails

Last, Datarails is financial planning and analysis software that automates data consolidation, financial reporting and budgeting. It integrates with common accounting software, ERPs and CRMs, providing a single system for financial data consolidation. Datarails is used by finance teams in many industries and offers AI-powered insights, making it a good option for strategic decision making.