Question: I need a financial assistant that provides weekly challenges to help me stay on top of my finances and reach my goals.

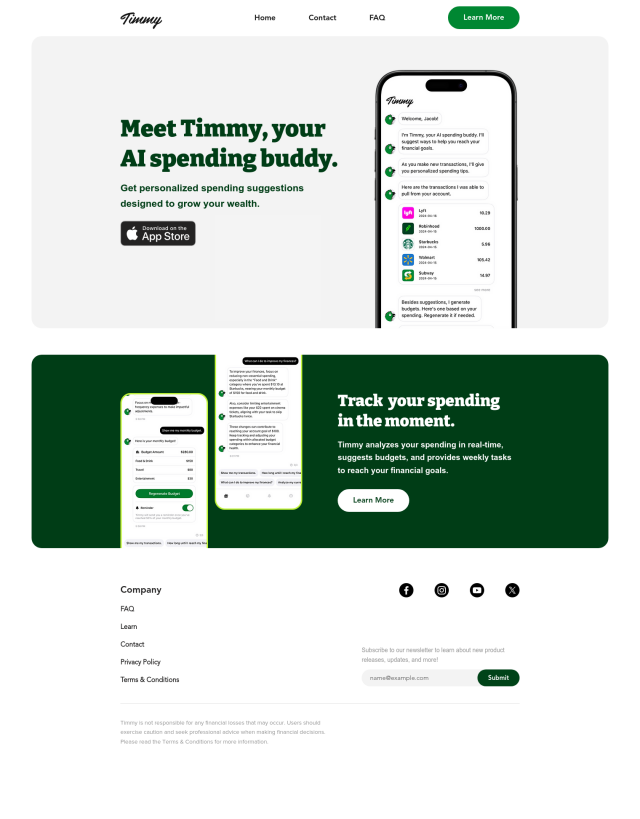

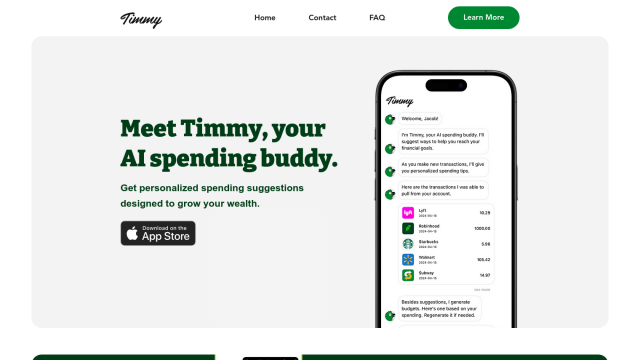

Timmy

If you want a financial assistant that gives you weekly challenges to keep you on track and working toward your goals, Timmy could be a good option. Timmy is an AI-based financial management app that offers you advice based on your spending patterns. It ingests transactions in real-time, generates a personalized budget and sends you a weekly to-do list to keep you on track. The app connects to your bank account through Plaid's secure connection and uses OpenAI's Language Model to generate recommendations.

Parthean

Another good option is Parthean, an AI-based financial management system that automates and simplifies a range of financial tasks. It has features like round-up savings, real-time spending analysis and personalized financial planning. Parthean also offers real-time spending notifications and personalized investment analysis. It uses bank-level encryption and anonymized data processing to ensure your data is safe, making it a good option for those who want to manage their money effectively.

Kniru

For a more personal touch, check out Kniru, an AI-based financial advisor platform. Kniru offers hyper-personalized financial management through chat, covering everything from investment advice to expense management to retirement planning. It includes features like personalized savings advice, bill due date reminders and overage notifications in your budget. Its conversational interface lets you stay on top of your financial activity and make good decisions.

Cashews

Last, Cashews gives you real-time visibility into your financial situation so you can track income and expenses, set goals and get smart alerts. It prioritizes user data privacy and security, so your information is kept private. Cashews helps you develop good spending habits and manage your money with automated tools and flexible tracking options.