Question: Is there a financial analysis tool that can provide industry-specific recommendations for my business?

FinanceGPT

If you're looking for a financial analysis tool that can offer industry-specific advice for your company, FinanceGPT could be just the ticket. This generative AI system, trained on financial data and expert advice, is designed to help investors, financial managers and accountants make more informed financial decisions. It comes with more than 14 financial analysis tools, including balance sheet analysis, cash flow analysis, credit analysis and more, and can be applied to a variety of industries including startup finance, investment banking and venture capital.

Finpilot

Another good option is Finpilot, an AI copilot that automates financial analysis workflows. Finpilot is good at processing data quickly, answering specific questions and showing trends. It can free up financial analysts and investment bankers to focus on higher-level analysis and decision making by taking over the grunt work of gathering and analyzing data, and delivering financial insights faster and more accurately.

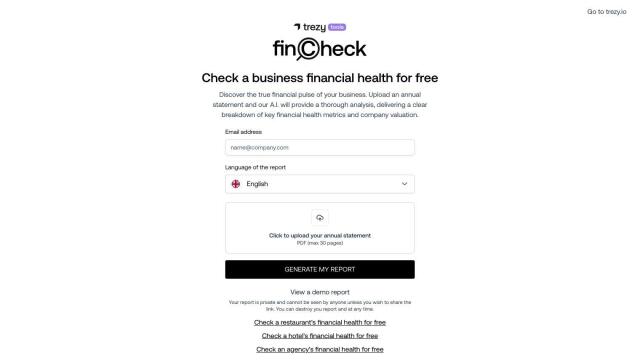

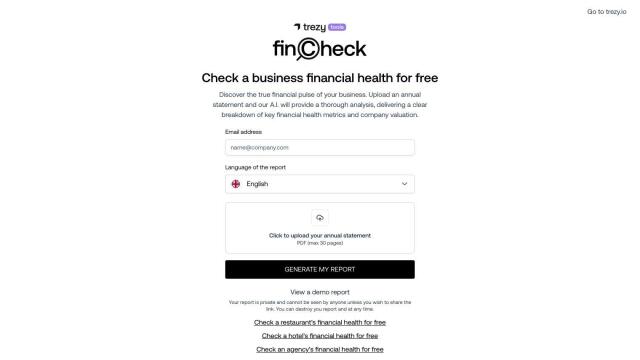

FinCheck

If your business is in a particular industry, FinCheck offers more in-depth financial analysis for hotels, retail stores and restaurants. You upload an annual statement, and FinCheck will give you key financial health metrics and advice specific to the industry, so you can run your business better and make more informed decisions.

Facta

Last, you could try Facta for consolidating and automating financial data from different sources into one data set. It's geared for finance pros who use Excel, with tools like complex calculations, real-time data updates and customizable business intelligence tools. Facta is good for private equity and venture capital, for example, where it can speed up modeling and centralize financial data for better accuracy and consistency.