Question: Is there a crypto investment platform that offers AI-driven trading strategies and dollar cost averaging features?

OctoBot

If you're looking for a crypto investment platform that offers AI-driven trading strategies and dollar cost averaging features, OctoBot is an excellent choice. OctoBot allows users to invest in theme-based baskets and use various trading strategies, including AI-based systems like ChatGPT Trend Master. It also supports dollar cost averaging, grid trading, and paper trading with virtual money. The platform connects to major exchanges and supports TradingView signals for automated trading, making it suitable for both individuals and institutional investors.

3Commas

Another strong option is 3Commas, which offers a variety of smart automated trading tools to optimize investment portfolios. It allows for the use of preconfigured trading strategies, including dollar cost averaging, grid, and futures bots. The platform supports automated trading on 14 major cryptocurrency exchanges and offers analytics dashboards to monitor performance. Additionally, it integrates TradingView indicators and strategies directly into cryptocurrency exchanges, making it a versatile choice for crypto investors.

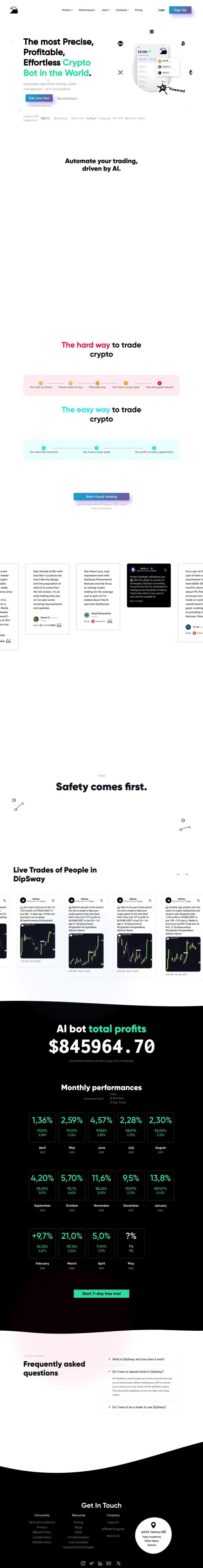

DipSway

DipSway is also a noteworthy platform, utilizing AI for fully automated 24/7 trading. It offers over 16 trading strategies and more than 121 indicators, ensuring that users have a wide range of options to choose from. DipSway supports multiple exchanges like OKX, BitMart, Bybit, and Binance, and provides detailed performance reports and reliable customer support, emphasizing safety and transparency.

Kvants

For those interested in institutional-level quantitative trading strategies, Kvants connects users with AI-driven methods developed by leading hedge funds. It offers a variety of trading strategies and features API trading, non-custodial Omni Chain and DeFi Vaults. Kvants supports multiple ecosystems and offers detailed investment information and performance metrics, making it a good option for users looking to enhance their portfolios with institutional-level methods.