Question: Is there a blockchain analytics platform that offers customizable alerts and portfolio management features?

Nansen

If you're looking for a blockchain analytics platform with customizable alerts and portfolio management features, Nansen is a top choice. It offers a suite of tools including powerful no-code analytics with Smart Alerts, portfolio management, wallet labeling, and on-chain data tracking. The platform also provides real-time dashboards and a Research Portal with professionally researched insights, catering to both individual crypto investors and teams. Pricing ranges from a free plan to a customizable Enterprise Plan.

CryptoQuant

Another excellent option is CryptoQuant, which provides comprehensive on-chain and market analytics. It offers customizable analytics tools, real-time alerts, and a drag-and-drop interface for no-code analytics. Users can create custom metrics, build interactive dashboards, and access a wide range of on-chain and off-chain data. This platform is designed for both trading and risk management, making it suitable for professional investors and institutions.

ChainGPT

For those interested in AI-powered solutions, ChainGPT offers a broad range of blockchain analytics tools, including fast on-chain data insights and an AI trading assistant. ChainGPT also includes SDKs and API access for developers, providing a versatile platform for both everyday users and businesses. Its pricing tiers range from a free plan to a custom enterprise plan, making it accessible for various needs.

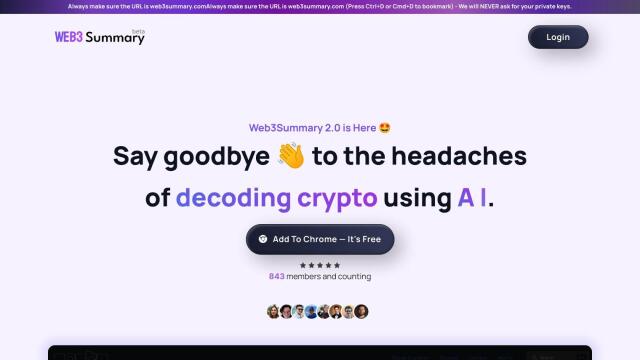

Web3 Summary

Lastly, Web3 Summary is a research platform that simplifies on-chain research using AI across multiple chains. It offers features like a Trading Terminal, Wallet Study, and Discord Bot, making it ideal for DeFi researchers and NFT flippers. With several pricing tiers catering to solo researchers to teams, Web3 Summary automates some of the complex research and investment decisions, providing AI-powered insights to enhance trading strategies.