Question: I'm looking for a tool that combines advanced analytics with conversational AI to streamline my investment research process.

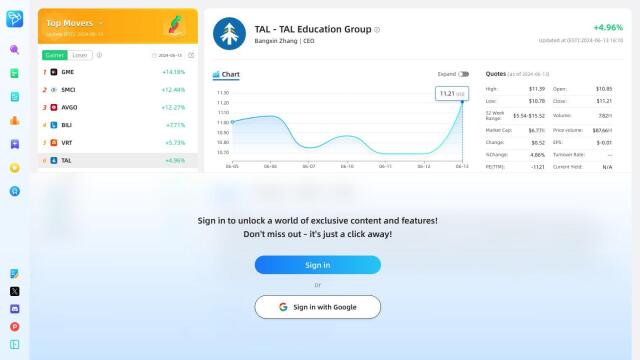

FinChat

If you're looking for a tool that marries advanced analytics with conversational AI to help you get a better handle on your investment research, FinChat is worth a look. It combines institutional-grade financial data and analytics with AI to help you research investments. It includes a customizable terminal, advanced data visualization, DCF modeling, and portfolio and watchlist dashboards. FinChat has access to financial data on more than 100,000 publicly traded companies around the world, and offers a variety of pricing options for individual investors, companies and financial services firms.

Fintool

Another powerful option is Fintool, an AI-powered equity research copilot that draws on SEC filings, earnings calls and conference transcripts. It can provide precise answers to complex questions and format financial information into tables. Real-time alerts help you spot trends in quantitative and qualitative data, financial news and industry developments. Fintool is geared for institutional investors, with enterprise-level security and the ability to generate memos and reports with real-time speed and auto-updating.

Toggle Terminal

Toggle Terminal also offers advanced analytics with the ability to ask questions in natural language. It includes scenario testing, asset intelligence, chart exploration and idea discovery, so you can test hypotheses and explore data without needing to know how to program. It's geared for institutional investors and asset managers who need a simple interface to get a deeper understanding of their data as quickly as possible.

FinanceGPT

If you're looking for a broader suite of financial analysis tools, check out FinanceGPT. The system combines generative AI and domain expertise to help investors make more informed financial decisions. It can aggregate real-time data, monitor financial health and generate custom forecasts, among other advanced analytics tools. It's geared for anyone who has a lot of transactions across multiple financial markets.