Question: I'm looking for an AI-powered research platform that provides accurate and up-to-date financial information from trusted sources.

Fintool

If you're seeking an AI-powered research platform with authoritative and up-to-date financial information, Fintool is a top choice. It's geared for institutional investors and combines SEC filings, earnings calls and conference transcripts to help you get precise answers to complex questions. The platform organizes financial metrics and KPIs into tables and can extract and export data in CSV format. Real-time alerts help you spot insights in quantitative and qualitative data, financial news and industry trends, making it a good choice for optimizing and speeding up equity research workflows.

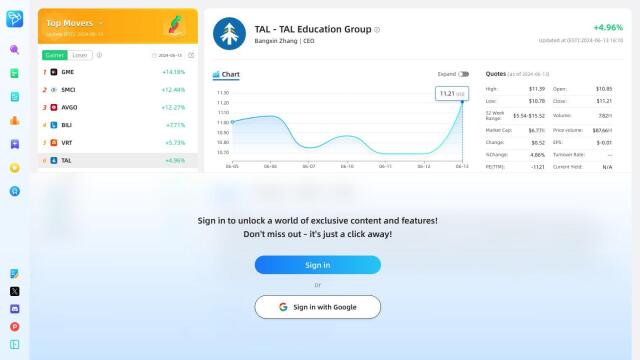

FinChat

Another top contender is FinChat, which marries institutional-grade financial data and analytics with conversational AI. It offers vetted, in-depth financial data validated by human equity analysts, along with features like customizable terminals, advanced data visualization, DCF modeling and AI-powered competitor comparisons. With access to vetted financial data on more than 100,000 global public companies, FinChat is for individual investors, companies and financial services firms.

AlphaSense

AlphaSense is a market intelligence and search platform that uses AI and NLP to help you find information in a vast library of more than 300 million documents. It includes company filings, broker research, expert calls and regulatory filings, and offers real-time monitoring and tracking so you don't get surprised. AlphaSense is designed to support data-driven decision making and is used by financial services firms, corporate strategy teams and healthcare companies.

Finpilot

If you're looking for a platform to speed up financial analysis workflows, Finpilot is worth a look. It uses proprietary AI to rapidly process data, answer specific questions and perform comparative analysis. Finpilot automates data collection and analysis so finance pros can focus on higher-level analysis and decision-making, and deliver faster and more accurate financial analysis.