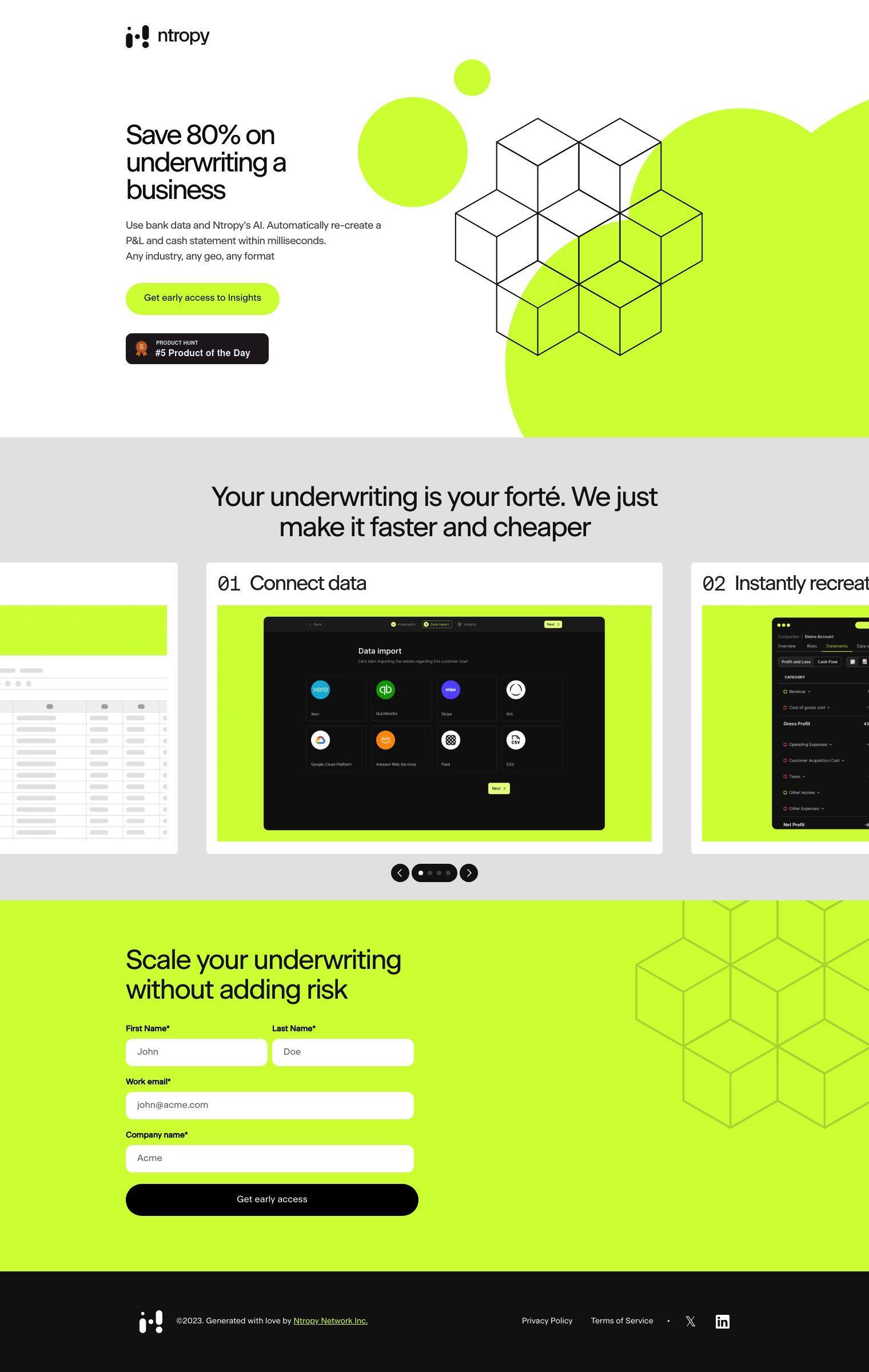

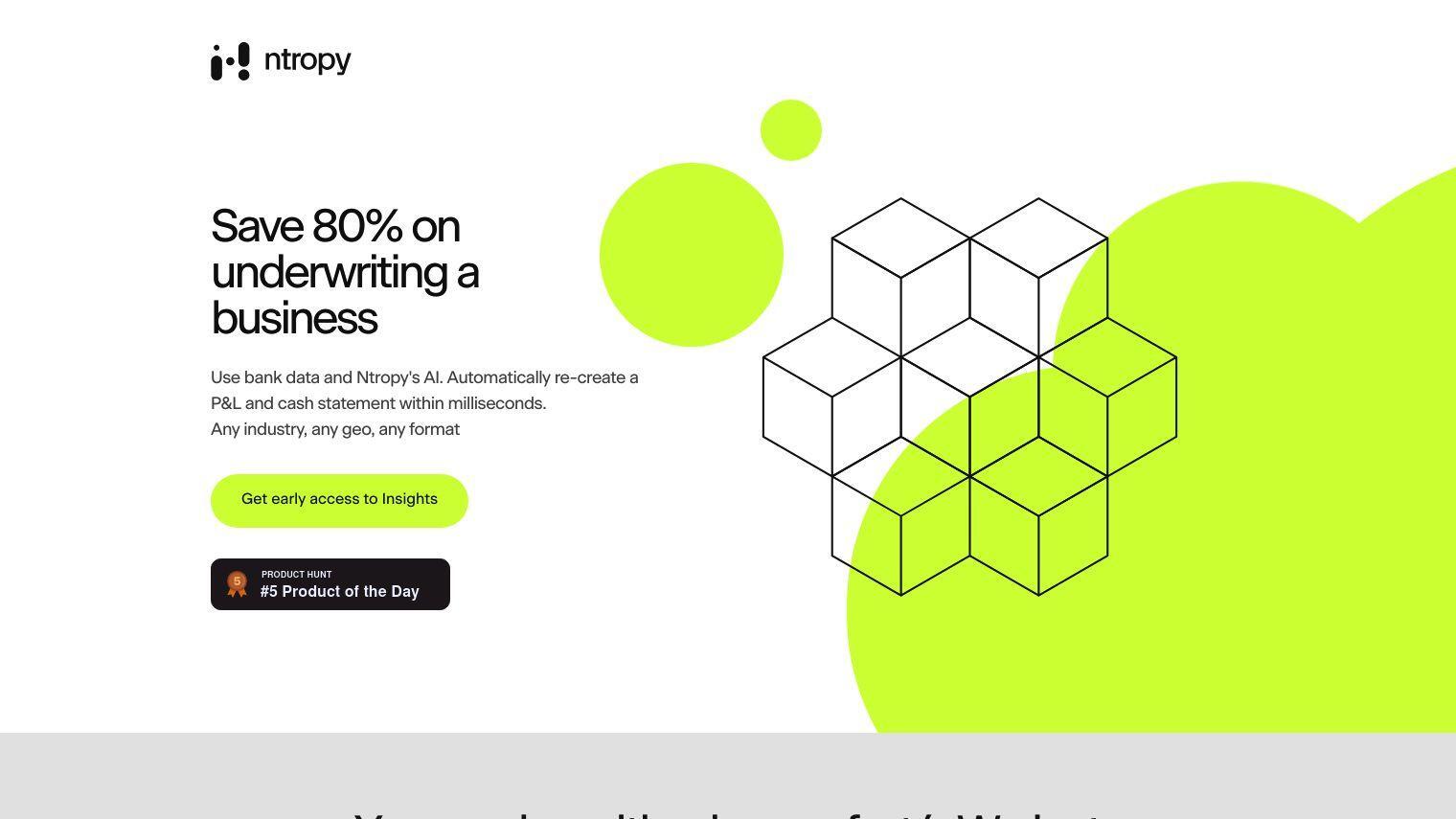

Ntropy uses AI to rapidly and accurately process bank data and statements, extracting the financial information that's most important, like revenue and COGs. That lets customers automatically generate a profit and loss (P&L) statement in a fraction of a second, for example, to help with business lending. The tool is designed to work for anyone, regardless of industry or geography, and to handle a wide variety of formats.

Ntropy's features include:

- Data Connection: Connect source bank data.

- Instant Financial Statement Recreation: Generate a P&L statement in a split second.

- Real-time Summaries: Get immediate financial summaries.

- Export and Modeling Capabilities: Process and apply financial data for further analysis.

With Ntropy, companies can cut underwriting costs by as much as 80% without sacrificing speed. The tool is geared for anyone looking to automate and scale underwriting while maintaining the accuracy and risk management that's critical to lending. Check out their website to see how Ntropy can help with your financial data needs.

Published on June 14, 2024

Related Questions

Tool Suggestions

Analyzing Ntropy...