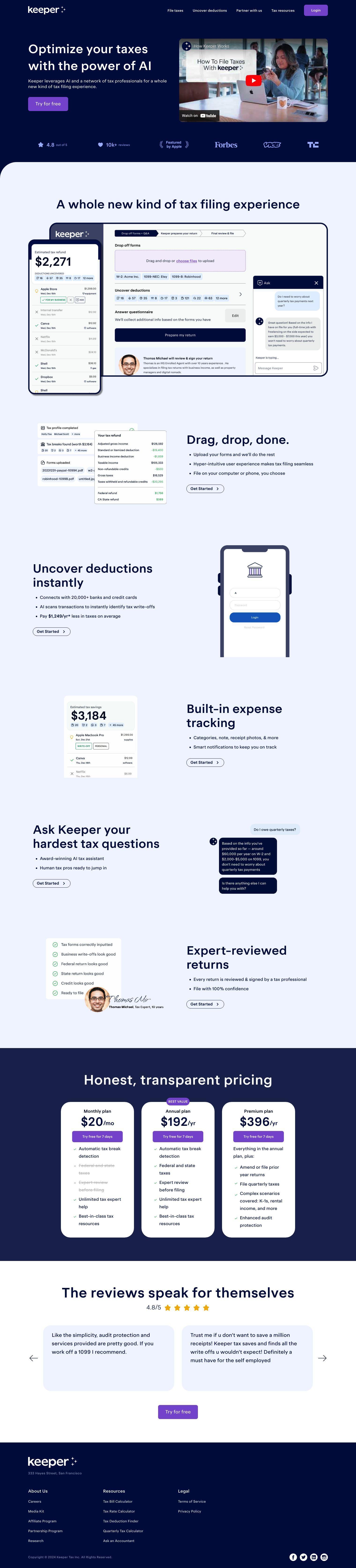

Keeper uses AI and a network of tax pros to help you get the most out of the tax filing process, with an interface designed to be easy to use. Upload forms, and the service takes over, automating much of the process and making it work on computers and mobile devices.

Among Keeper's features:

- Drag and Drop: Upload forms, and the AI engine takes over.

- Hyper-intuitive UX: A clean, intuitive interface for a painless tax filing experience.

- Bank and Credit Card Connections: Links to more than 20,000 financial institutions to find tax deductions.

- Expense Tracking: Categorize, annotate and photograph receipts for expense tracking.

- AI Tax Assistant: The award-winning AI system for quick tax questions and human tax pros for more complex issues.

- Expert-Reviewed Returns: Every return is reviewed and signed by a tax pro for peace of mind.

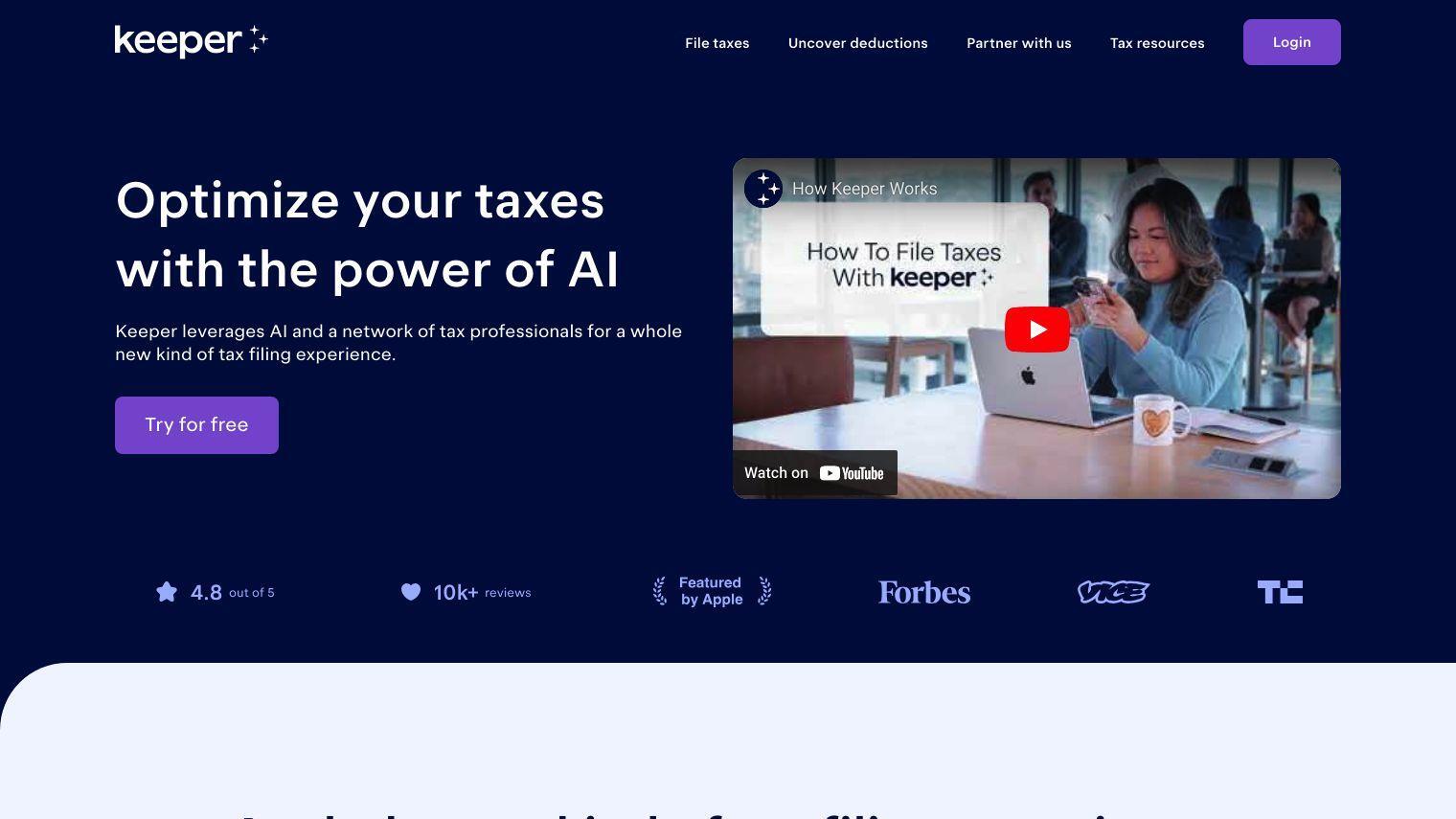

Keeper has three pricing tiers:

- Monthly: $20 per month, including automatic tax break detection, federal and state taxes, expert review, unlimited tax expert help and best-in-class tax resources.

- Annual: $192 per year, including the same as the monthly plan.

- Premium: $396 per year, including the ability to amend or file prior year returns, file quarterly taxes, handle complex situations and better audit protection.

Keeper is geared for self-employed people and small businesses. It automates tax break detection and offers expert review before filing. People like it for ease of use, audit protection and the breadth of tax resources.

Published on June 13, 2024

Related Questions

I'm looking for a tax filing service that can automatically detect tax breaks and has expert review before filing. Can you recommend a user-friendly tax preparation platform that supports mobile devices and has a clean interface? I need a solution that can connect to my bank and credit card accounts to find tax deductions, can you suggest one? Is there a tax filing service that offers AI-powered assistance and unlimited access to human tax professionals for complex issues?

Tool Suggestions

Analyzing Keeper...