Question: Is there a platform that offers unsecured financing with no personal guarantees or warrants for technology expenses?

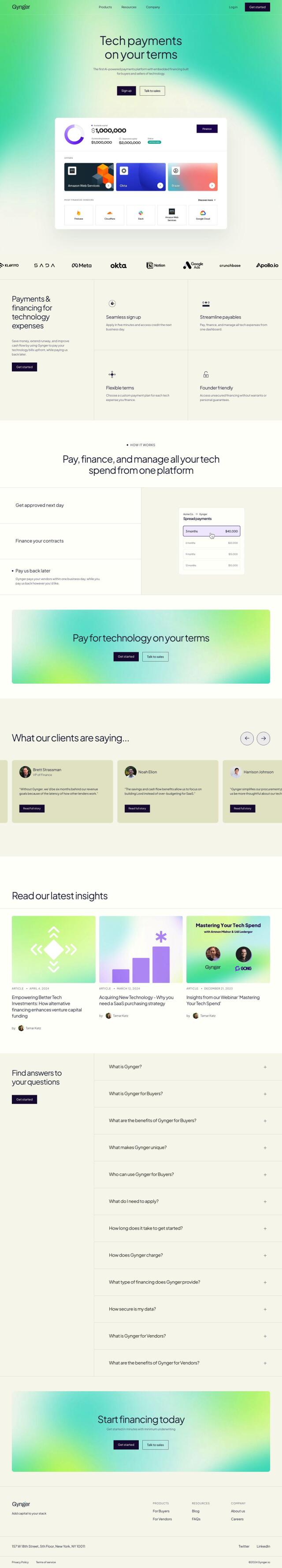

Gynger

If you're looking for a platform that offers unsecured financing with no personal guarantees or warrants for technology expenses, Gynger is a good option. Gynger is an AI-powered payments platform that offers embedded financing specifically for businesses that purchase technology. It lets businesses pay their tech bills upfront and repay the financing later, which can help them save money, extend their runway and improve their cash flow. The platform offers a simple onboarding process, streamlined payables and flexible terms with no warrants or personal guarantees. The intuitive dashboard makes it easy to upload invoices and choose custom repayment terms.

Brightflow AI

Another alternative is Brightflow AI, an eCommerce financial intelligence platform that helps businesses manage cash flow and secure growth capital. It doesn't offer specific financing for technology expenses, but it offers tools to manage cash positions, secure growth capital and make data-driven financial decisions. With features like real-time financial insights, daily/weekly/monthly cash flow tracking, and expert advice on funding options, Brightflow AI can help small to medium-sized businesses manage their finances and drive growth.

Gynger

If you want a more comprehensive view of financial operations, Gynger is probably the better choice, offering custom financing options for technology expenses. But Brightflow AI can offer useful insights and tools to help businesses manage their finances and make better decisions about their growth strategy.