Question: I need a way to quickly understand my company's financial health without requiring extensive financial expertise.

FinanceGPT

If you need a way to get a quick handle on your company's financial situation even if you don't have a lot of financial expertise, FinanceGPT is a great option. It combines generative AI with financial data to perform advanced financial analysis, including real-time data ingestion and customizable forecasting. With 14 financial analysis tools, including balance sheet and cash flow analysis, FinanceGPT helps you make better decisions by providing actionable insights based on advanced analytics and expert knowledge.

Finpilot

Another option is Finpilot, an AI copilot designed to automate financial analysis workflows, rapidly analyzing data and answering specific questions. Finpilot also performs comparative analysis and visualizes trends, so you can focus on higher-level analysis and decision-making instead of digging through research.

whatifi

If you prefer a financial modeling and forecasting approach, whatifi offers a tool to create and share "what if" cash flow forecasts and financial models in real-time. It integrates with common financial software and offers a decision-tree-like interface for tracing transactions, so you can easily simulate different business scenarios and make quick, confident decisions.

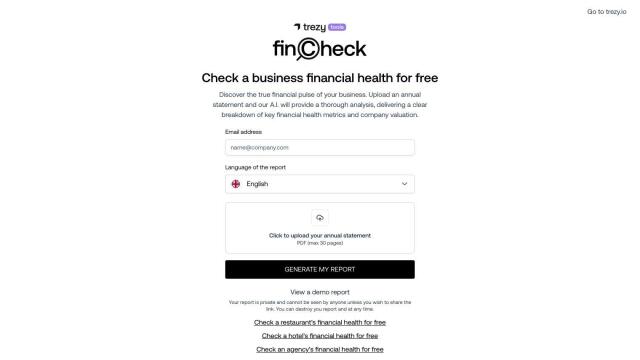

FinCheck

Finally, FinCheck offers an in-depth analysis of key financial health metrics and company valuation by uploading an annual statement and using AI. It's designed for specific industries, such as agencies, hotels and e-commerce sites, so businesses can quickly assess financial performance and optimize operations.