Question: Do you know of a platform that offers a comprehensive risk management solution for financial services and capital markets industries?

Orbit Risk

For a more comprehensive risk management solution for financial services and capital markets, Orbit Risk is a good choice. The platform digitizes and automates risk management processes with features like centralized risk analysis, continuous cyber risk monitoring and a portfolio risk dashboard for real-time monitoring. It's designed for financial services, capital markets and fund services companies looking to manage cyber risk, third-party risk and protect assets and reputation.

Moody's RMS

Another good option is Moody's RMS. The platform combines data, models and expertise to help you tackle complex risk management challenges. With tools like Risk Modeler, TreatyIQ and ExposureIQ, Moody's RMS offers detailed risk analytics, including catastrophe event analysis and exposure analysis. It supports a wide range of risk models so you can estimate economic loss and make better decisions in many industries.

LexisNexis Risk Solutions

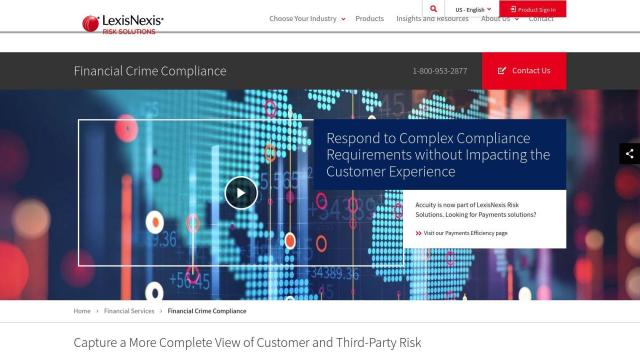

LexisNexis Risk Solutions offers a flexible risk management platform for financial services, insurance and government customers. It offers insights for managing financial crime compliance, credit risk, fraud and identity management. The platform uses advanced analytics and a large database to improve risk detection and compliance, and is designed to help you make better decisions and work more efficiently.

LexisNexis Risk Solutions

For a more detailed solution for financial crime compliance, check out LexisNexis Risk Solutions. The platform uses advanced analytics, machine learning and AI to provide detailed customer and third-party risk assessments. It includes tools for customer identification, continuous monitoring and compliance with global regulations like the USA PATRIOT Act and FinCEN guidelines, helping you to better manage financial crime risk and compliance.