Question: Can you recommend a platform that automates insurance pricing model creation and management?

Swallow

If you're looking for a platform to automate the creation and management of insurance pricing models, Swallow is a top contender. Swallow provides a no-code builder, end-to-end model management and a variety of AI tools for tasks like data ingestion and quality testing. It also has collaboration, auditability and version control tools, making it a good choice for a variety of stakeholders, including actuaries, compliance teams and developers. The result is a streamlined process for creating and managing pricing models, with real-time data ingestion and live publishing.

UiPath

Another option is UiPath, a business automation platform that's got AI and automation abilities that can help you work more efficiently and productively in many industries. It's not the first place you'd think of for insurances, but its process mining, task mining and automation abilities could help you automate some of the work that goes into creating and managing insurance pricing models.

Obviously AI

If you want to try a no-code data science approach, Obviously AI could be helpful. It automates data science workflows so you can build and deploy machine learning models without having to write much code. Features like fast model creation, one-click deployment and automated model monitoring can be helpful for predicting things like pricing dynamics, and it could be a good choice for those who want to add AI abilities to their pricing models.

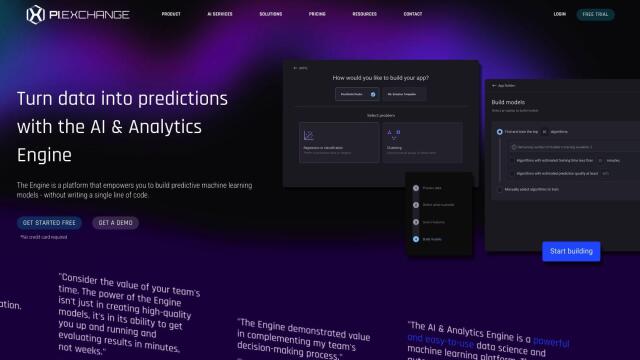

PI.EXCHANGE

Finally, PI.EXCHANGE has an AI & Analytics Engine that lets you create predictive machine learning models without having to write code. Its tools for data prep, model development and deployment let you create an end-to-end ML pipeline for teams and individuals. Its collaborative environment and pricing tiers mean it can be adapted to different business needs, and it could be a good choice for insurance pricing model management.