Question: Can you recommend a tool that helps institutional investors analyze financial data from SEC filings and earnings calls?

Fintool

If you're looking for a tool to help institutional investors analyze financial data from SEC filings and earnings calls, Fintool is a standout option. Fintool is an AI-powered equity research copilot built on a foundation of SEC filings, earnings calls, and conference transcripts. It offers precise answers to complex questions, structures financial metrics into tables, and extracts and exports data in CSV format. Real-time alerts and enterprise-grade security make Fintool a comprehensive solution for institutional investors, with plans that cater to both buy-side and sell-side customers.

AlphaSense

Another excellent choice is AlphaSense. This platform uses proprietary AI and NLP technology to quickly find information in a massive library of documents, including company filings and broker research. It cuts manual research time and allows real-time monitoring of information. AlphaSense is used by major financial firms and companies, offering tools for market intelligence and data-driven decision making.

AlphaResearch

AlphaResearch also offers robust features for institutional investors. It uses AI and NLP to extract insights from unstructured text, including company filings and earnings call transcripts. The platform includes advanced data analytics and a powerful search engine that indexes millions of filings worldwide, saving users significant research time. AlphaResearch provides unique insights and collaboration tools, making it suitable for institutional investors and corporate strategists.

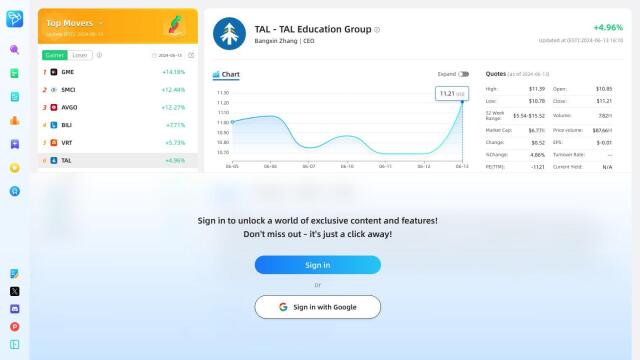

FinChat

For a more integrated research platform, consider FinChat. It combines institutional-quality financial data and analytics with conversational AI to streamline research. FinChat offers advanced data visualization, DCF modeling, and AI-driven competitor comparisons, providing access to accurate financial data on over 100,000 global public companies. This platform is designed for individual investors, companies, and financial services firms, offering various pricing tiers to suit different needs.