Question: I need a solution that provides a visual representation of my financial situation and offers alerts and notifications.

Sequence

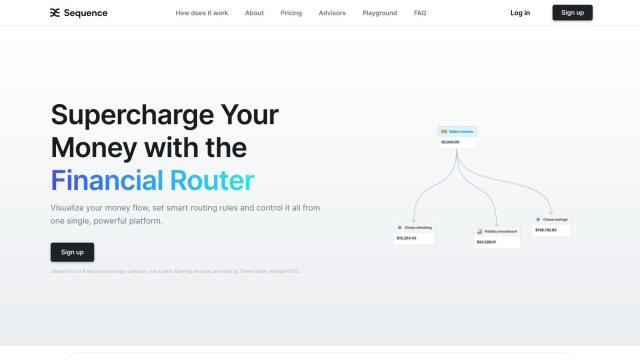

If you want a service that offers a visualization of your financial situation and alerts and notifications, Sequence is worth a look. The service automates and visualizes financial management by linking to multiple financial accounts, including checking, savings, brokerage, credit cards and crypto wallets. It offers a dynamic UI money map that shows your balance in real time and sends live notifications. With smart rules and IF statements, you can automate your own actions to maximize your savings and investments. Sequence also offers instant transfers, scheduling and security features like FDIC insurance up to $3,000,000.

Parthean

Another option is Parthean, an AI-based financial management service. It automates and simplifies financial tasks like savings, investments and debt repayment. Parthean offers round-up savings, real-time spending insights and personalized financial planning. You can get real-time spending alerts and transfer money between accounts within the app. The service is designed with security in mind, using bank-level encryption and anonymized data processing. It also offers a 1-month free trial so you can try it out before paying.

Canua

Canua offers a broad view of your financial life by tracking accounts, investments and taxes. It pulls in data and organizes it automatically so you can get a better view of your financial situation. With automatic FBAR report filing and integration with more than 17,000 banks and brokerages, Canua is geared for people with complicated financial lives. It protects data with bank-level encryption and has a network of licensed financial professionals for advice.

Kniru

Last, Kniru offers personalized financial advice and insights through an AI-based advisor. It covers a range of financial planning topics, including investment advice, expense management and retirement planning. Kniru offers personalized savings advice, bill due date reminders and budget overages. The service is designed to keep you on top of your financial activity with easy-to-use dashboards and notifications. It can link accounts in the United States, Canada and India, with the UK coming soon.